The Only Value Investing Crypto Newsletter | 100% hype free

Interacting with us easy! Just hit reply to this email and we’ll email you back! Or you can post in the comments section—remember if you have a question others probably do too.

Please share with any crypto junkies or crypto noobs you think would enjoy our content:

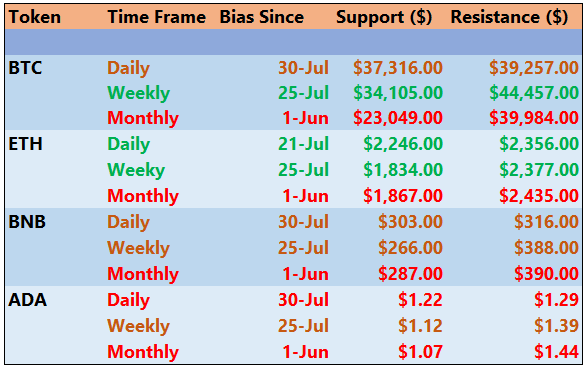

CHEAT SHEET

(You can print this out at work to follow along.)

It looks like we are finally getting a pull back in this massive rally. You could try setting bids near the daily support around $37.5k or set them near $35k, which is a bit above the weekly support.

What We Are Watching

Send us emails or write in the comments questions you have about why we like these tokens or what you’d like to hear more about.

Bids on Sushi at $7.58 and MATIC at $0.91 could be a great place to enter a long.

We further breakdown our case for these cryptos here : What We Are Watching

DeFi News

A new wallet, Slingshot, allows you to connect your Coinbase wallet and access DeFi on Polygon Network.

Some leaked screen shots from one of Sushiswap’s new developments. We aren’t sure the exact details of this, but it looks like it allows you to create your own cryptocurrency and control the tokenomics.

TAKE ME TO (BTC) MAXI TOWN

Bitcoin finally stopped going straight up! The price has stalled out near June’s peak of approximately $41,000. So, what happens next?

I know it’s a busy chart but let me walk you through it.

This morning the price bounced off of the 200 day EMA. This was also the short term Fibonacci golden pocket given by the quick retracement a few days ago. This pull back coincided with the RSI being unable to break above level 70. This means we’ve lost short term buying momentum.

Where does the price go then? Because the price bounced off the 200 day EMA and Fibonacci golden pocket maybe that’s the end of the pull back. The price could stay near this Fib zone and pick up liquidity. Many traders like to put limit buy orders in these golden pockets so it is possible there is strong buying support here and we go sideways for a bit before continuing higher.

If there is not enough support and we fall below the 200 day EMA and short term Fibonacci golden pocket we will most likely fall all the way to the next support zone near $35,000. This lines up with another Fibonacci golden pocket based on the mid term rally. This also lines up with the EMA Ribbon (a group of lower time frame EMAs) which are converging near $35k.

One last thing is the EMA ribbon appears to be flipping. This is when the lower time frames start to rise above the higher time frames. This tends to be a good reversal signal though it is a lagging not a leading indicator.

Possible Course of Action

Place small limit buy orders in the short term Fibonacci golden pocket (basically buy now) or put larger limit buy orders in the mid term Fibonnaci golden pocket near $35k

If the price falls below 200 Day EMA. Open a short till near $35k.

Price Action Summary

The Bulls’ Defense:

Still above 200 Day EMA

On-chain analysis shows whales are taking Bitcoin off exchanges in large quantity

The Bears’ Prosecution:

RSI was not able to get above level 70. If price falls below 200 day EMA no major support until $35k.

Recent News

Bitcoin whales accumulate $5.2 Billion in the past 28 days.

FOOT GUNS (FAKE NEWS ALTER!)

The Article says : “Massive outflows see bitcoin exchange balances plummet to 2018 levels” False!! Untrue!

Look these people posted this article even though the source they used (@WClementeIII) literally said this was unconfirmed in the first reply to his own tweet. He then gave the answer saying this was an internal flow inside of Kraken not an exchange outflow.

We asked Will Clemente to clarify some information about the Exchange Outflows statistic and have not received an answer. Go like our tweet and maybe he’ll respond.

ETH SHY BOY ZONE

This is a potential W-shaped bottoming pattern. The price has now gone above the neckline of the pattern and is retesting it as support. If this support can hold the pattern’s technical target is near $3000 ETH.

However, volume has been declining the past week with the trend. In order for us to go higher a large volume increase would need to be in unison with a significant price rise. If the price cannot stay at or above the neckline then we’d expect a fall back to the $2150 support level.

Possible Course of Action

If neckline holds here and price rises again today or tomorrow with volume to match then we’d recommend buying into the rally (buy high, sell higher).

Wait for price to break below the neckline and catch a quick short to near the first level of support at $2150.

The Bulls’ Defense:

W pattern forming with potential upside to $3000.

The Bears’ Prosecution:

Declining volume with recent price rise. Could indicate a short term trend reversal and a fall back to $2150.

Recent News

Ethereum network on pace to settle $8 trillion in 2021.

Please share with any crypto junkies or crypto noobs you think would enjoy our content:

Well, Pull Back Canceled! 10 Green days in a row since Foot Guns launched.