#25 It's Over 9000!

The Law of Big Round Numbers

The Only Value Investing Crypto Newsletter | 100% hype free

The $9000 Meme

If you go to reddit.com and search in /r/Bitcoin for “over 9000” you’ll see 80+ posts over the last four years all saying the same thing.

For those that are new to the space, Bitcoin had a wild run at the end of 2017 and went from $8000 to $19000 between November and December. However, after that moment of exuberance the Bitcoin price fell all the way into the low $3000s in a multi-year, bear market. You can imagine that after experiencing Bitcoin’s price rise so high and then fall so low, Bitcoin holders were in need of some excitement.

You can see from this chart that they eventually got that excitement, over and over again. The horizontal blue line is drawn right at the $9000 level. In the latter half of 2019, the “It’s Over 9000!” meme was all the rave, but the meme didn’t really get old until the summer of 2020 when the price went up and down around the $9000 level over and over again. So many times in fact people on the Bitcoin subreddit started getting tired of the “It’s Over 9000!” Vegeta Meme. (In case you don’t know what Dragon Ball Z is. Here’s the origin of the meme.)

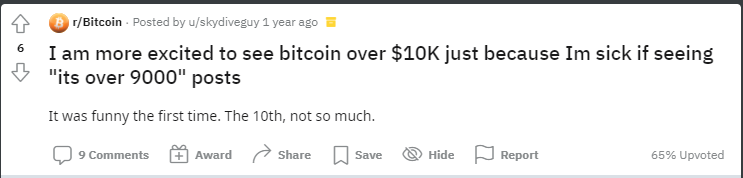

It was only one year ago that this redditor posted in celebration as Bitcoin’s price went above $10k, simply because they were sick of seeing “It’s Over 9000!” posts. Even funnier the top comment suggests they switch to denominating Bitcoin in British pound sterling because it was still under 9000 GBP at the time, and this would give the original poster one more chance to see the meme in its full glory.

The Law Of Big Round Numbers

The point of all this is that humans become fixated on big round numbers. Bitcoiners locked onto the $9000 level because of the popularity of the Vegeta meme. This became a major resistance and then support level over the last 4 years of Bitcoin’s price history. Coincidentally, the Stock-To-Flow Model created by @100trillionUSD predicted the average price of Bitcoin from 2016 - 2020 would be around $8400. However, that’s not a big enough, round enough number. Get rid of that four! There’s plenty of room for another 0, but rather than $8000 (the nearest round number) the community chose $9000, probably because of the Vegeta meme.

Today we are experiencing another big round number moment. The technicals all indicate Bitcoin’s next major resistance is at $52.1k, but the price quickly fell from the $50k level and it now hovering near by. Even the news that MicroStrategy has acquired another $177M worth of Bitcoin is not enough to break this physiological barrier.

Looking at Bitcoin’s price history, if you simply draw horizontal lines at $30k, $40k, $50k, and $60k you can see the effect of the Law Of Big Round Numbers on the price. The price appears to ping pong back and forth between big round numbers. It has almost teleported between the $40k and $50k level spending little time in between. Maybe because $50k is such a nice, even, and round number nicely snuggled halfway between $0 and $100k.

The next time you are considering buying or selling Bitcoin think about the Law Of Big Round Numbers. Will Bitcoin go to $100k, $200k, or even $300k this year? Who knows? But you can bet everyone is calling for a Big Round Number. Just look at this Forbes Headline.

Not just Bitcoin. Ethereum too. If he gave a prediction for Cardano and Solana you can bet it would be a big round number as well. So, if everyone is calling for a Big Round Number you can bet they are planning to take profits at a Big Round Number as well. The real question is what will be the new Vegeta Meme for Bitcoin’s price over the next four years?