#3 Something's Stable

Lets talk Stablecoins. Today we take a deep look at the Circle Public Listing

The Only Value Investing Crypto Newsletter | 100% hype free

Welcome to our new subs. It’s our first week existing and we are happy you are here. This week all our publications are free. After that we will occasionally put out free publications, but if you want to stay up to date with the most relevant crypto news join our community by subscribing here:

CHEAT SHEET

(You can print this out at work to follow along. Some green today, but don’t get too excited.)

Red = Bearish, Green = Bullish, Brown = Neutral since the date given in “Bias Since”. Support levels are where the price could bounce when falling and Resistance levels are where the price could stop if rising. You can find more details on how to read the cheat sheet here.

What We Are Watching

Red = Bearish, Green = Bullish, Brown = Neutral since the date given in “Bias Since”. Support levels are where the price could bounce when falling and Resistance levels are where the price could stop if rising. You can find more details on how to read the cheat sheet here.

We further breakdown our case for these cryptos here : What We Are Watching

News About What We Are Watching

SUSHI - If you are a SUSHI holder you may be eligible for a FOX airdrop.

LUNA - A bridge now exists to allow users to move funds back and forth between Terra’s blockchain and the Harmony blockchain. LUNA can now be staked with VIPER on viper.exchange .

MATIC - NFT marketplace, NFTically, raises fund from Polygon Matic CEO.

AAVE - Turns out rAAVE was a - RAVE.

TAKE ME TO (BTC) MAXI TOWN

Have you ever watched a Television series where some crazy thing happens in Episode 5 then in Episode 6 the writers explain away all of the crazy things with some plot hole. That’s what just happened to Bitcoin in the last 3 days. Now in just two back to back 4 hour candles we’ve reclaimed all of the last 3 days lose.

You can see on the chart the falling wedge outlined by the red dashed lines. The drop out of the bottom of this wedge was looking bearish. Now, we are back at the top side of the wedge and looking to break out. A quick move back to $33k looks likely. The big question will be if $33k can be broken as well. We expect the price to pause at $33k and be argued over.

Possible Course of Action

Put on a small long when we go above the top side of the falling wedge and look to sell just before $33k.

You could also wait for the price to consolidate around $33k and open a long position only when we make a significant move above $33k. The target would then be just under $40k

Price Action Summary

The Bulls’ Defense:

An over night rally reclaimed the recent sell off

On-chain metrics show the area around $30k has strong buying support

Historically Bitcoin price has reverted toward the stock to flow prediction

The Bears’ Prosecution:

Price remains below 200 Day Moving Average

Recent News

Mastercard creates Bitcoin payment card.

Bitcoin Mining History Museum opens in Venezuela

A collection of Bitcoin whale wallets, dormant since 2018 add $841 million to their holdings.

After recent funding round FTX receives an $18 billion valuation.

ETH SHY BOY ZONE

Wow, that was fast. Remember those support and resistance lines we gave you on yesterdays chart? ETH has no desire to be anywhere besides at major support and resistance lines. We are back at support around $1900 and often old supports become new resistance. It would be a short term bullish sign if ETH just blew threw the $1900 level and reclaimed $2200.

Possible Course of Action

Open a small long here with the aim of selling just below $2200. Close the trade quickly if we fall back below the $1900 support.

You could also wait for us to break $2200 before scaling into a long with the price target of $3000.

The Bulls’ Defense:

Fast reclaim of key $1900 level.

Possible Inverse Head and Shoulders forming

The Bears’ Prosecution:

Price retesting 200 Day moving average. A failure to rise above it should keep us in a bearish trend.

Recent News

The Maker Foundation is closing to become a fully Decentralized Autonomous Organization (DAO).

Ethereum Documentary project raises 1036 ETH.

Flows into Ethereum Funds crawl back as Bitcoin outflows continue.

Congratulations you bought it! Here’s what you bought actually does.

Stablecoins

Stablecoins promise to be stable but are riddled with Foot Guns.

There’s been a ton of headlines recently about Circle’s SPAC, struck at a $5.4 billion valuation. Circle is a company that issues and maintains a stablecoin called USDC. Today we will discuss what stablecoins are, their history and the Circle public offering.

Tether - The First Stablecoin

A stablecoin is simply a cryptocurrency that retains a stable value against an existing real world currency like the US dollar or the Euro. What makes them cryptocurrencies is that they are built on top of their own or an existing cryptocurrency network. The first widely used stablecoin to be adopted is called Tether.

Tether came into existence on 20 November 2014, when co-founders Brock Pierce, Reeve Collins and Craig Sellars announced the project will support tokens built on the Bitcoin Blockchain Omni Layer Protocol. While Tether originally began on the Bitcoin Omni Layer it has also issued tokens on other blockchains such as: Ethereum, EOS, Tron, Algorand, SLP and OMG. The Tether foundation originally promised it would issue USTether, EUROTether and YenTether stablecoins, and that every token would be backed by its original currency and could be redeemed at any time with no exposure to exchange risk. However, throughout its history the Tether foundation has lacked transparency into this promise of one to one backing.

By January 2017 there were nearly $10 million worth of Tether tokens in circulation. A year and a half later this number grew to a massive $2.8 billion and at that time Tether accounted for up to 80% of the Bitcoin volume. A suit filed in April 2019 accused Bitfinex (one of the world’s largest cryptocurrency exchanges) for using Tether reserves to cover up an $850 million loss. The cover up was a result of a banking relationship Bitfinex had formed with Crypto Capital Corp who ran away with investor funds and Bitfinex never informed their investors.

In an attempt to clean up its reputation, Tether publish a report in March 2021 detailing its reserve assets. It was revealed that only a small percentage was actual cash reserves. A large portion of their holding (75%) was actually cash plus cash equivalents. The break down of the 75% : Commercial Paper (65%), Fiduciary Deposits (24%) and Cash (4%). The other 25% of their holdings consists of : 12.5% secured loans, 10% Corporate Bonds and 1.6% digital tokens. This shows clearly to the market that Tether does represent a credit risk to investors. However, with the transparency the risk can be more easily assessed and is no longer a known unknown to the market.

In 2021 Tether has continued to see its market cap grow rapidly, expanding from $21 billion in January to now $62 billion in July. Coinbase has recently listed Tether as one of the tokens available to it’s users.

The Stablecoin Market

According to coingecko.com the total market capitalization of all stablecoins is $112 billion with just over $45 billion in daily trading volume. This is about 10% of the $1.4 trillion total cryptocurrency market cap and represents more than half of the $78 billion in the last day's trading volume. Tether is currently the third largest cryptocurrency by market cap below Bitcoin and Ethereum.

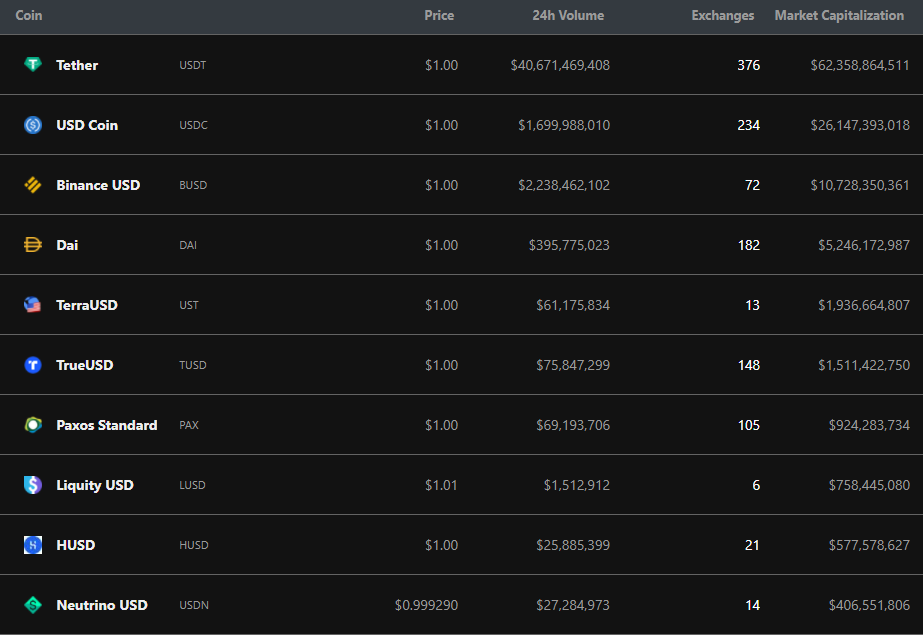

While Tether remains the most used stablecoin, it only accounts for half of the total USD value stored in stablecoins. There are a wide range of competitors. Here are the top 10 by market cap:

You can see the second-largest competitor is USDC. That is the name of the token issued by Circle Internet Financial Inc. We are going to talk about them in a second because they recently announced a public listing in the United States through a SPAC. Before we go on, note that although Tether has three times as large of a market cap as USDC, the 24-hour trading volume for Tether is more than twenty times the volume of USDC.

Round and Round - Circle Public Offering

Founded in 2013 by Jeremy Allaire and Sean Neville, Circle issues and maintains a stablecoin known as USD Coin. As we have noted above Tether has faced harsh criticisms about lacking transparency around its cash reserves. Circle is attempting to set itself apart from Tether in its public offering. Jeremy Allaire said one reason for the public offering was “to increase the level of transparency around its stablecoin. Being a publicly traded company in the U.S. should blunt those criticisms.”

It makes sense that Circle sees value in bolstering investor confidence in the cash reserves backing USDC. On 15 October 2018 the price of Tether fell off its dollar peg down to $0.88 due to a perceived credit risk from investors. On the Bitfinex exchange traders sold their Tether en masse into Bitcoin driving down the Tether price. If this were to happen to USDC this would not be a good look for Circle Internet Financial Inc.

Let’s take a look at this Significant Opportunity…

It looks like Circle is projecting its user base to 10x in the next three years (YOLO!), and if you read further in the presentation they actually only have about 1,200 accounts at the time of writing (so more like a 20x). If they can achieve this their revenue will 10x and there will be nearly three quarters of a trillion dollars in USDC in circulation by 2023 years end. These are some bullish projections, aye?

They clearly view themselves as unstoppable, but they do outline one risk in small print:

“We face intense and increasing competition and, if we do not compete effectively, our competitive positioning and our operating results will be harmed.”

Let’s talk about one of these competitors that’s been gaining some head winds recently.

Terra Luna

TerraUSD has recently become the fifth-largest stablecoin by market capitalization at just under $2 billion dollars. Why do we need more stablecoins? First Tether, then USDC and now TerraUSD. What’s the difference? As we said earlier, USDC is separating itself from Tether by establishing itself as a publicly traded company so investors will have faith in the reserve assets backing the token. Terra takes a completely different approach.

TerraUSD (UST) is described as an algorithmic stablecoin that is pegged to the US Dollar using another asset as collateral (also a crypto token): Terra LUNA (the one we have on our watch list) . Here’s the description of how the system works from coingecko.com:

"The Terra network achieves price stability by algorithmically adjusting its supply based on fluctuations in demand. Once it detects that a Terra stablecoin has deviated from its peg, it will apply pressure to correct the deviation.

The protocol makes use of natural market forces to achieve this. For instance, if the price of 1 TerraUSD (UST) is above its $1 US dollar peg, the protocol must compensate by increasing the supply of UST. It mints some of the stablecoin and sells them on the open market. Arbitrageurs can then swap $1 US dollar worth of Luna in exchange for 1 TerraUSD and stand to profit. Minting and swapping occur until the supply of new UST is sufficient to bring back UST’s peg.

Likewise, should the price of 1 TerraUSD drop below its $1 US dollar target, the protocol will decrease the supply of the stablecoin. It mints Luna and sells them on the open market. Profit seekers can then exchange 1 UST for $1 US dollar worth of Luna and pocket the difference. In both cases, the Terra protocol prints as much stablecoin or Luna as necessary until the peg for each asset is satisfied.”

If you are still confused. Here’s an animated explanation:

Terra is its own blockchain and governance system that can mint stablecoins to match any real currency. Cool! The market cap of Terra is growing fast, rising from $300 million in January 2021 to $3 billion at present. Here at Foot Guns we are expecting the Terra ecosystem to continue growing at a rapid pace. If the current rate of growth continues we expect Terra to be a strong competitor to Circle’s USDC and Tether.

If you are looking to take a position in Terra’s LUNA it is not available on US exchanges yet. In the true spirit of Decentralized Finance, LUNA is available for trading using Uniswap.

Have a great day and stay stable!

If you enjoyed this content subscribe here (remember this week’s free) :

Please share with any crypto junkies or crypto noobs you think would enjoy our content:

Remember we have $32,800 as the daily resistance bias on our cheat sheet