Don’t miss the latest podcast for premium subscribers only : “Why Didn't Anyone Do Anything About That”

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, ETH, OIL, ES, and NQ as well as our favorite altcoins.

Crypto News

European Union's landmark crypto regulation passes parliamentary vote (The Block)

Crypto traders suffered $253 million in long liquidations during market dip (The Block)

DeFi-Focused Layer 1 Berachain Raises $42M Series A at $420.69M Valuation (CoinDesk)

Bitcoin Drops to $29K in Sudden Sell-Off (CoinDesk)

Voyager Strikes Deal to Proceed With Billion-dollar Binance.US Asset Acquisition (Blockworks)

Web3 Onboarding Just Got Easier: ENS Users Can Buy .ETH Name With Fiat (Blockworks)

Coinbase Receives Bermuda License, Outlines Global Expansion Plans (Decrypt)

Dutch Court Agrees to Free Tornado Cash Dev Alex Pertsev Pending Trial (Decrypt)

Fallen crypto king Do Kwon slapped with fake passport charge in Montenegro (DL)

ETH Outlook

Since today is a international holiday we thought we’d follow up on last weeks Shapella Upgrade post and analyze the impacts of the upgrade one week later.

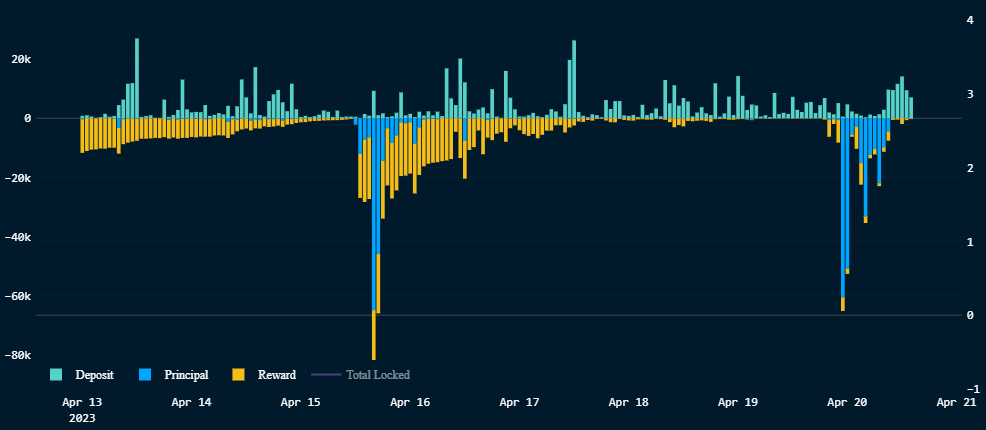

First off, they upgraded the metrics on Nansen to show withdraws separated by Principal and Rewards. The Principal is the ETH that was originally staked in order to support the Proof-Of-Stake network and earn Rewards as part of the POS system.

As you can see in the chart above, the early withdraws were mostly comprised of staking rewards rather than the original staking principal being unstaked. It was about three days after the upgrade went live before significant principal withdrawals were starting to be seen. Over the entirety of last week, while rewards and principal were being withdrawn, new stakers were continuing to stake and in substantial quantitates. Over the weekend withdrawals nearly disappeared only to have a large number of principal withdraws emerging this morning after the price declined over 8% in 24 hours.

From the price chart over the period since withdrawals began there is no clear correlation of price being impacted by withdrawals or staking. Comparing the two charts, it appears the opposite effect is occurring. The price declined by a large percentage yesterday (04/19) and principal withdrawals started emerging after the price declined. One could conclude from this that it was the price declined that motivated stakers to withdraw their principal to be able to sell and hedge against further decline.

The ETH/BTC pair has held up quite well during the last two days of declining price. This leads one to believe that ETH’s price decline is being lead by an overall crypto market sell off and not something specific to withdrawals. In fact, from all of this evidence one could hypothesis that Bitcoins price decline brought ETH down with it in USD terms causing entities to withdraw their staked principal in order to hedge. Its behavior like this that makes crypto markets reflexive in natures. Price drives behavior and that is why you see such large volatility and cycles of bullish and bearishness that drives price far to the left or right.

Join us in discord where we will continue to monitor ETH’s price action in response to the Shanghai (Shapella) upgrade.

Possible Course of Action

HODL if long spot

Do nothing and wait for ETH to reclaim $2k and hold as support

Look to buy near $1900 (big round number) if it holds as support

The Bulls’ Defense:

Early withdrawals were staking rewards

$1900 big round number support

ETH/BTC pair holding

The Bears’ Prosecution:

Price rejected $2000

Principal withdrawals following declining price

Want more from Foot Guns? Join our Discord where we have live conversations about the market.