New Year New You

"In the garden, growth has it seasons. First comes spring and summer, but then we have fall and winter. And then we get spring and summer again." -Chance The Gardener

It’s a brand new year and an exciting day for the cheat sheet. It’s one of the rare days when the new daily bias, new weekly bias, new monthly bias, are all updated on the same day. We’re here to make sure you start the year off with more intuition and knowledge than most other market participants.

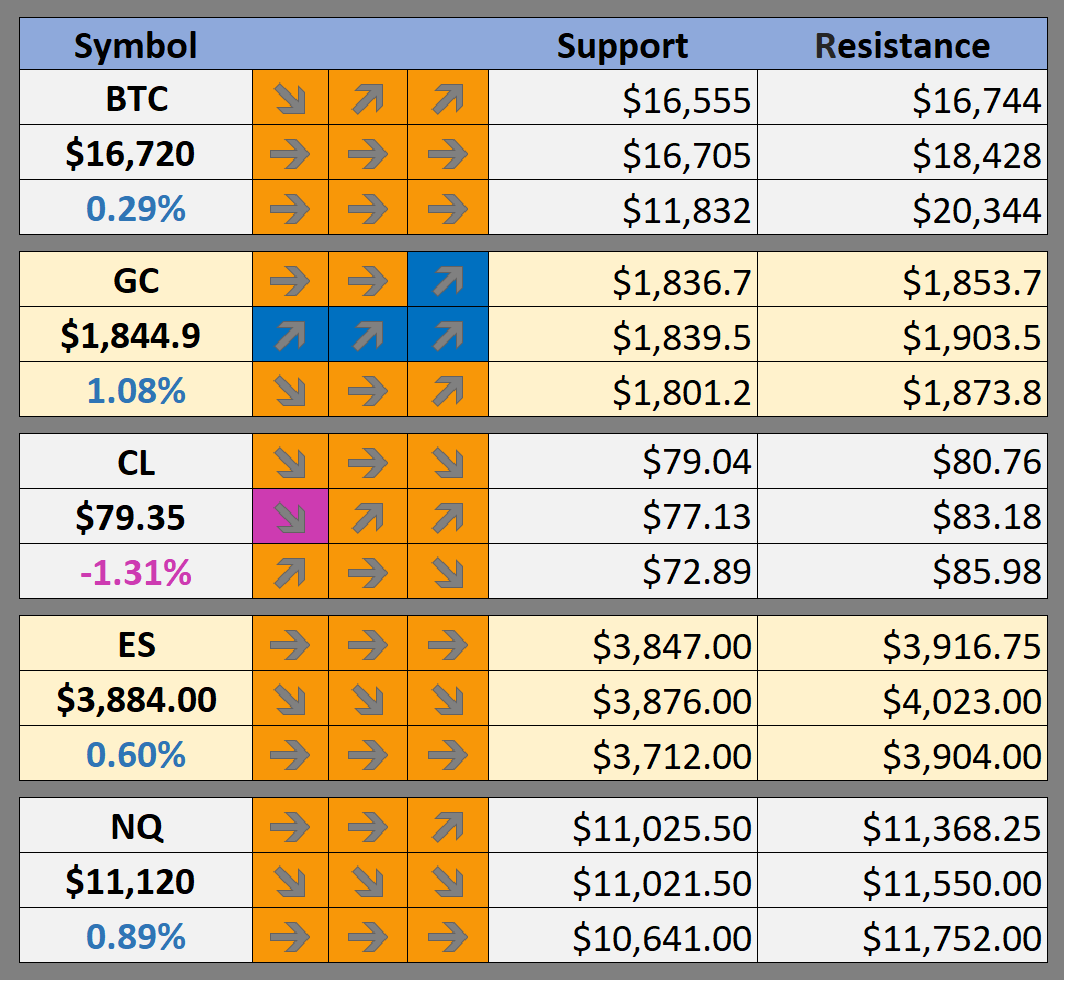

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, GC, CL, ES, and NQ as well as our favorite altcoins

Are you new to Foot Guns? Learn how to read the cheat sheet here.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Investors will need 'a very strong stomach' to invest in web3, says Union Square Ventures' Fred Wilson (The Block)

Gemini users file class-action request against Genesis and DCG: CoinDesk (The Block)

DeFi Protocol Sushi to Shutter Lending Product to Focus on DEX(CoinDesk)

Ethereum's Impending Shanghai Upgrade Powers Lido DAO, SWISE, RPL Tokens Higher (CoinDesk)

The Top 8 NFT Marketplaces for Investors, Creators (Blockworks)

Binance is Back in South Korea With Latest Acquisition: Report (Blockworks)

Gemini’s Winklevoss Slams DCG CEO Silbert for ‘Bad Faith Stall Tactics’ Over $900M in Locked Funds (Decrypt)

Final Fantasy Maker Square Enix Reaffirms Focus on Blockchain Games (Decrypt)

Bahamas Regulator Hits Back at ‘Cavalier’ New FTX Bosses (Decrypt)

BTC Outlook

We are happy to have you here with us at Foot Guns. Especially, to have had the pleasure of being with you during one of the wildest years in market history, and an historic year for crypto specifically. About everything that could go wrong in 2022 did. But, it’s a new year and while we will take the lessons of the past with us forward it’s time to focus on the future again.

This is the rare moment of the year when Bitcoin’s yearly candle closes and a new one begins and we can use the past to make some educated guesses about the future. Because Bitcoin is such a young commodity there is not much technical structure on the yearly time frame yet. This means the best one can do it to read the tea leaves of the candles. Really this means four pieces of information : The yearly open and close and the high and low trade for the year.

Well there is one simple “technical pattern”: Bitcoin has never had two consecutive down years. This would mean if history repeats we can safely assume Bitcoin’s price will close above the yearly open around $16600. This is an example of a thesis you could use in 2023 to build a trade or investment and then based on that you could come up with some parameters for a stop loss or take profit.

Another observation to take away from the yearly chart is that most candles have wicks. Because the price went up immediately at the yearly open this means there is no bottom wick so far this year. Yet another idea that could be used as the thesis for a short in 2023.

Key levels to watch this year are:

$13,800 is the close for 2017 therefore open for 2018 and was the top tick in 2019. This is a critical support level to watch in 2023

$7000 is the 2019 close/2020 open another key support level to watch

$28,000 is the 2020 close/2021 open this is is a key resistance level to watch in 2023

One final observation is if history repeats Bitcoin should never trade below $7k or above $45k in 2023.

Take a moment to familiarize yourselves with these levels for the coming year. Remember that this is all based on history repeating and will allow you at easily determine if a new regime really is forming and breaking history.

Possible Course of Action

Long here expecting to hold for 1 year with some downside inbetween (Bitcoin has never had two consecutive red years)

Short into strength expecting a bottom wick this year

Do nothing wait opportunities on lower time frames

The Bulls’ Defense:

Bitcoin has never had two consecutive red years

The Bears’ Prosecution:

Global uncertainty , recession fears

No bottom wick so far this year on the yearly candle

A Closer Look

This section will be focused on taking a closer look on what Hal thinks is important to watch in the coming week.

This morning Hal reviews an altcoin and the Nasdaq with a focus on how to trade the two unique technical patterns currently forming.

Keep reading with a 7-day free trial

Subscribe to Foot Guns to keep reading this post and get 7 days of free access to the full post archives.