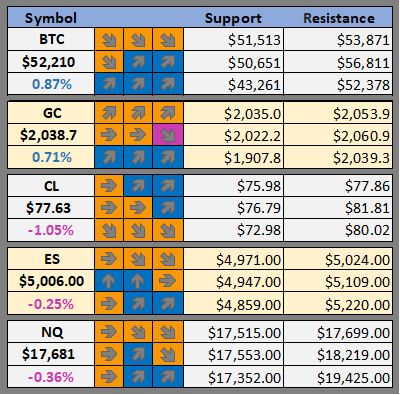

Cheat Sheet -

Current support and resistance ranges plus our bias on top cryptos, oil, and stocks.

Are you new to Foot Guns? Learn how to read the cheat sheet here.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Liquid restaking protocols surge past $3.5 billion in total value locked (The Block)

Crypto funds hit $2.5 billion weekly inflow record amid growing spot Bitcoin ETF interest (The Block)

Hong Kong crypto stocks surge, OKX to invest in L1s: Asia Express (CoinTelegraph)

Polygon-based lending platform to provide crypto liquidity for luxury items (CoinTelegraph)

Bitcoin Order Books Are Most Liquid Since October as Market Depth Nears $540M (CoinDesk)

UK Minister Expects Stablecoin and Staking Legislation Within Six Months: Bloomberg (CoinDesk)

What does EIP 4844 mean for Ethereum rollups? (Blockworks)

Wall Street is missing out on DeFi (Blockworks)

Pixels Trading Volume Hits $1.2 Billion as Ethereum Gaming Token Tops Major Coins (Decrypt)

Executive texts claim Deltec moved customer funds from FTX to Alameda (Protos)

Angry Texans fight Bitcoin mine’s 80,000 noisy machines in test for industry (DLNews)

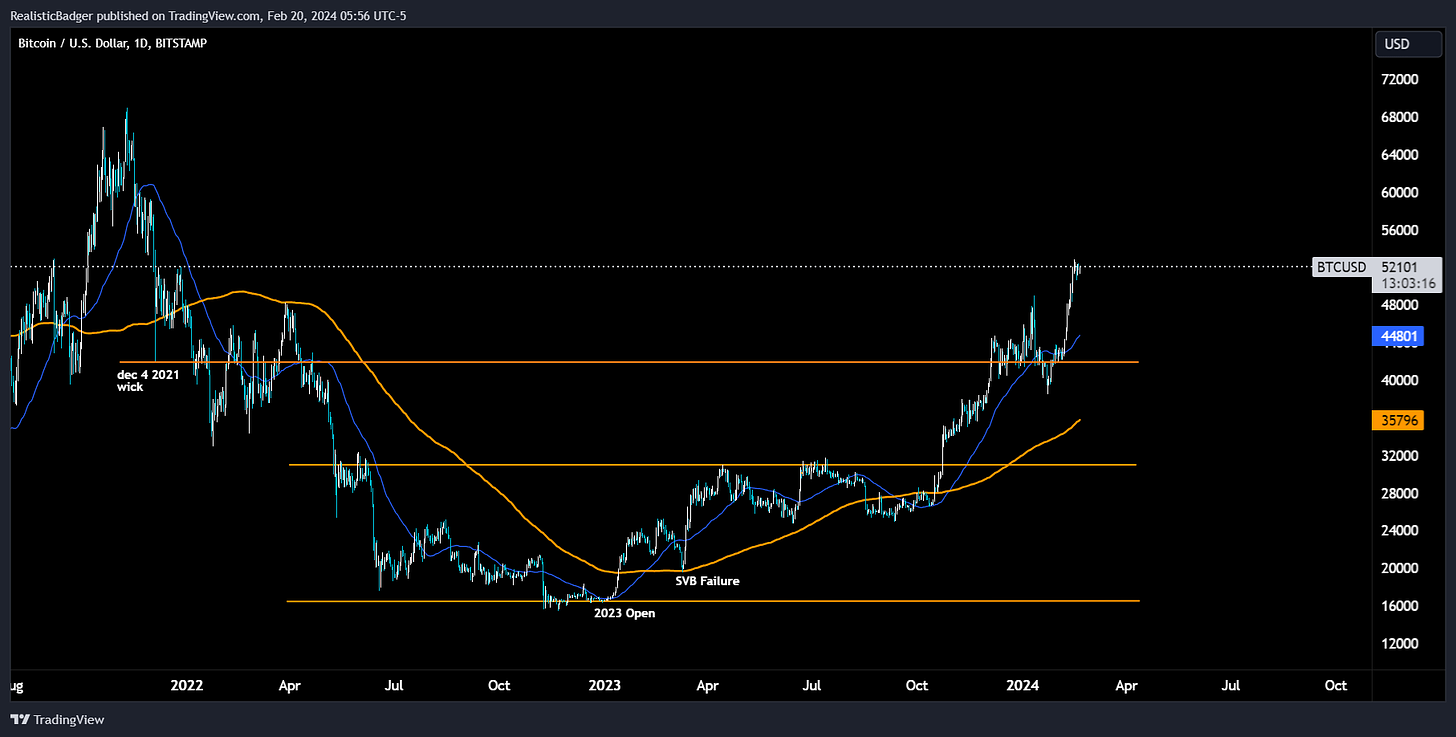

BTC Outlook

Over the long weekend Bitcoin’s price managed to reclaim and hold onto $52k after selling off on Friday evening and Saturday morning. At the time of this writing, the price is sitting nearly exactly at $52k, which now appears to have become a consolidation point over the last two weeks. The price managing to find strength over the long weekend is a sign of a shifted sentiment in the Bitcoin market. From late 2021 to mid 2023 the long holiday weekends, where us equity markets were closed, were typically correlated to sell offs.

The price is currently trading far above the 50 day and 200 day moving averages and both averages are now rising rapidly with the price. These are both two points to consider being a buyer on a retrace even though it’s likely the sentiment will be bearish if these prices are reached again in the short term.

There have been stronger than expected inflows into the BTC ETF products and this could be an reason why the price has had such strong upward momentum while market sentiment has remained somewhat neutral as everyone anticipated the ETFs to be a sell the news event.

Eyes are focused this week on NVDA earnings (02/21/24 after market close) which could have a strong impact on US equity market sentiment. However, Bitcoin appears to be bucking the trend ever since the ETF launch and it is possible that even with sell offs in the magnificent seven or the opulent one (NVDA) that Bitcoin just continues to slowly climb higher. In the past though, crypto followed equities downward during large selling periods.

Join us in discord where we will actively be following Bitcoin’s price action as well as other markets including equities, altcoins, and commodities.

Possible Course of Action

DCA into spot long over Q1 in anticipation of Halving (2024 summer)

Long near 50 day MA or 200 day MA

Short or sell near or above $52k expecting it to act as resistance

The Bulls’ Defense:

Price still trading above 50 day and 200 day MA

The Bears’ Prosecution:

CPI report above expectations

$52k acting as resistance

Want more from Foot Guns? Join our Discord where we have live conversations about the market.