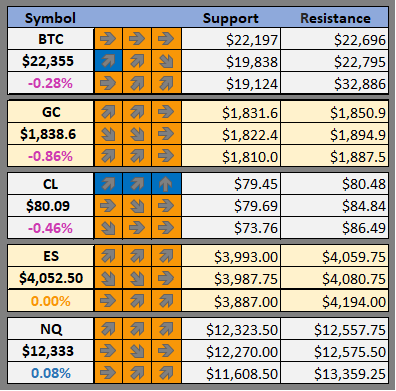

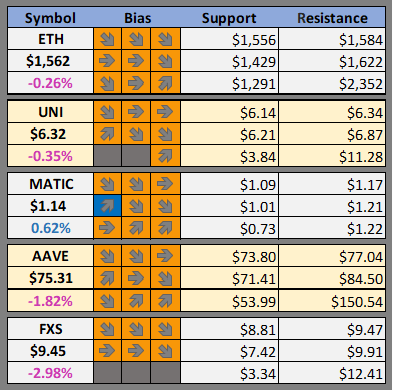

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, GC, CL, ES, and NQ as well as our favorite altcoins

Are you new to Foot Guns? Learn how to read the cheat sheet here.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Paxos survey shows 75% of respondents 'confident' in the future of crypto (The Block)

Serial entrepreneur and ex diplomat Trevor Traina raises $25 million for 'goof-proof' web3 superapp (The Block)

White House Is 'Aware of' Silvergate Situation, Spokeswoman Says (CoinDesk)

Multicoin Capital’s Hedge Fund Lost 91.4% Last Year, Investor Letter Reveals (CoinDesk)

DAO gets legal recognition in the US as Utah DAO Act passes (CoinTelegraph)

Hermès Says Trademark Lawsuit Win Over MetaBirkins NFTs Isn’t Enough (Blockworks)

Circle Dropped Automated Clearing House Payments (Blockworks)

Alameda Sues Grayscale Over $9 Billion Locked in Bitcoin Trust Shares (Decrypt)

SEC Shuts Down '$100 Million Crypto Fraud' in Miami (Decrypt)

DeFi 'threat' drives $1.5B tokenisation boom as Goldman, SocGen eye on-chain bonds (DLNews)

BTC Outlook

For those of you that read every week we will go ahead and apologize on behalf of Bitcoin’s price action. The price has gone absolutely no where for the past 4 days and is currently hovering around the same price as BTC was on Jan 18th. Meaning after the first couple weeks of 2023 all of the whipsaw has resulted in no progress for the bulls.

An important technical note is that BTC is no longer trading above its 50 day moving average which is now around $23k. The next likely support is the FTX local top around $21.5k and as you can see under that is the 200 day moving average (in orange) which is all the way down around $19.5k still.

Also, note that when most assets fall through a major moving average that moving average tends to become resistance. So, we can expect any rally back up from here to meet resistance at the 50 day moving average and could consolidate around those levels if there is another sustained rally.

We are expecting more chop with a bit of downside until inflation numbers for March are released and then more importantly the fed’s reaction function. The inflation number won’t come in until next week and the fed’s decision the following. We are expecting continued chop in the price until then.

We will be paying close attention to these key support and resistance levels this week. Join us in discord where we actively discuss markets and where Bitcoin could be headed next.

Possible Course of Action

Do nothing wait for Bitcoin to rise above $23k and hold it as support before buying

Short expecting a retest of $21.5k, or $19.5k

Do nothing and wait for $21.5k or $19.5k to hold as support

The Bulls’ Defense:

Price still above the 200 day MA

The Bears’ Prosecution:

Double top at $25.3k

Price below 50 day MA

A Closer Look

This section will be focused on taking a closer look on what Hal thinks is important to watch in the coming week.

This morning Hal gives an update on the Dogecoin and what it tells us about risk appetite in crypto.

Keep reading with a 7-day free trial

Subscribe to Foot Guns to keep reading this post and get 7 days of free access to the full post archives.