Don’t miss last weeks podcast. Hal, Boomer discuss what’s going on with oil, commodities and how it may impact Crypto.

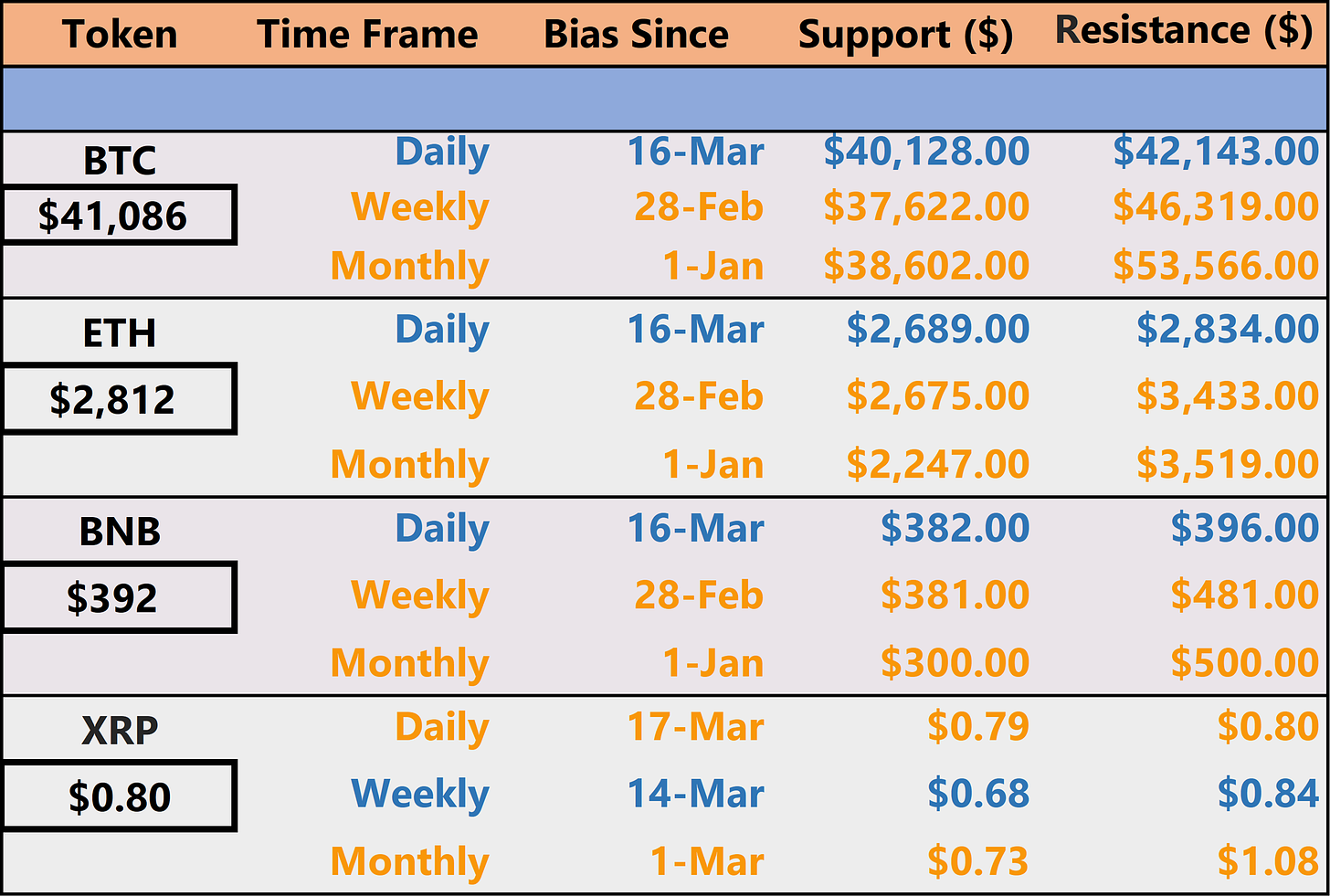

CHEAT SHEET

The price has been moving around so much it seems to be creating noise in the daily bias on the cheat sheet. We flipped bearish the day before the price ran up, and now flipping bullish on a huge down move. It could be wise to trade less here and focus on the weekly and monthly time frames. Alternatively, if you are paying close attention join us in our Discord where we are more closely following the price action.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Are you buying these tokens? Did you read our guide on how to buy them on Sushiswap and Uniswap? Got questions? Leave them in the comments.

Crypto News

Ukraine's Zelenskyy Signs Virtual Assets Bill Into Law, Legalizing Crypto (CoinDesk)

Mark Zuckerberg Says NFTs Are Coming Soon to Instagram (CoinDesk)

Stellar Development Foundation Launches $30M Investment Fund (CoinDesk)

‘We’re already buying:’ Terra founder plans to obtain $10B BTC for reserves (CoinTelegraph)

Congress members concerned SEC stifling innovation with crypto scrutiny (CoinTelegraph)

Rarible Adds Polygon NFTs and Multi-Wallet Support to Marketplace (Decrypt)

New Job Openings at Spotify Indicate a Move to Web3 Technology (Decrypt)

HSBC Buys Virtual Real Estate in Sandbox Metaverse (Blockworks)

FTX and AZA Finance Collaborate To Support Web3 Growth in Africa (Blockworks)

BTC Outlook

BTC has formed a large triangle pattern since it’s run up in early 2021. We’ve reached a point of tightening volatility and the price is coiled. This generally results in a large move whichever direction the price breaks out. In order to be bullish BTC needs to trade about $42k and hold it as support. If this attempt at a breakout is rejected, we’d then expect the price to retest the bottom of the triangle near $34-$36k. BTC is currently trading above the 50-day Moving Average. We outlined why this is significant in our article last week. The curvature of the 50-day MA is also inflecting, switching from a negative slow to positive. This is showing that buyers are coming back into the market.

Possible Course of Action (advice from last week still holds)

Wait for confirmation (BTC holding 50 MA as support)

Buy dips with small size

The Bulls’ Defense:

Higher Low is a show of support

Trading above 50-day MA

Potential breakout of multi-month triangle

The Bears’ Prosecution:

Failure to hold 50-day MA would show a sign of weakness

ETH Outlook

Since December 7th 2021 ETH has lost nearly -25% against BTC. You can see now that the ETH/BTC ratio is attempting to break out of this down trend. If the price can now hold the down slope as support, we’d expect ETH to outperform BTC in the short term. We do expect that if BTC is unable to stay above its 50-day moving average that ETH/BTC will sell off further. It is however a bullish sign that ETH/BTC ratio is going up because historically when BTC trades above its 50-day moving average people start to buy altcoins.

Possible Course of Action

Long here watching BTC and ETH/BTC pair closely

Short any signs of weakness (BTC fails to break out)

Do nothing and wait for confirmation (holding support)

The Bulls’ Defense:

EIP-1559 has burned $5,596,788,827 (1,987,122 ETH) so far. Supply constraints should continue to have a positive impact on price.

ETH/BTC potential breakout of downtrend

The Bears’ Prosecution:

Downtrend since Dec 7 2021 still intact

BTC must hold 50 day MA as support

Please don’t forget to like (heart button at bottom) and share this post!