Want more from Foot Guns? More podcasts, daily cheat sheets, defi guides and access to our private discord channels.

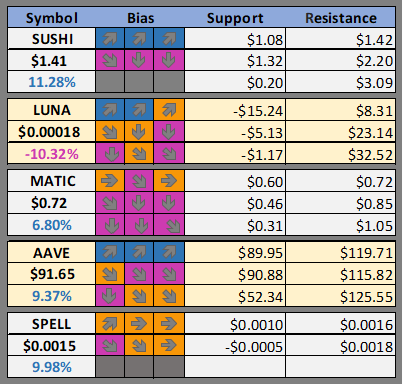

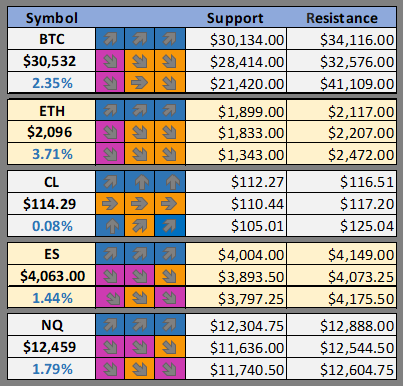

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, ETH, OIL, ES, and NQ as well as our favorite altcoins.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Jump-Backed Wormhole Bridge Expands to Algorand Blockchain (CoinDesk)

EY Unveils Supply Chain Manager on Polygon Network (CoinDesk)

Fireblocks Deploys ‘Web3 Engine’ for Firms Eyeing GameFi, NFTs (CoinDesk)

US congress research agency weighs in on UST crash, notes gaps in regulation (CoinTelegraph)

BitMEX launches spot crypto exchange following $30M penalty (CoinTelegraph)

Bitcoin, Bukele and a bevy of central bankers meet in El Salvador (CoinTelegraph)

Coppola-Backed Decentralized Pictures Launches Web3 Film Funding Platform (Decrypt)

Cloudflare Expected to Run Ethereum Nodes as Merge Event Approaches (Decrypt)

Paxos, State Street, and Credit Suisse Trial Permissioned Blockchain for Same-Day Trade Settlement (Decrypt)

Dawn Capital, Goldman Sachs Plow $70M Into Crypto Infrastructure Provider (Blockworks)

Australian Tax Office Cautions Crypto Investors to Declare Capital Gains (Blockworks)

Terra's LFG Reveals What Happened to Its Bitcoin Reserves (CryptoBriefing)

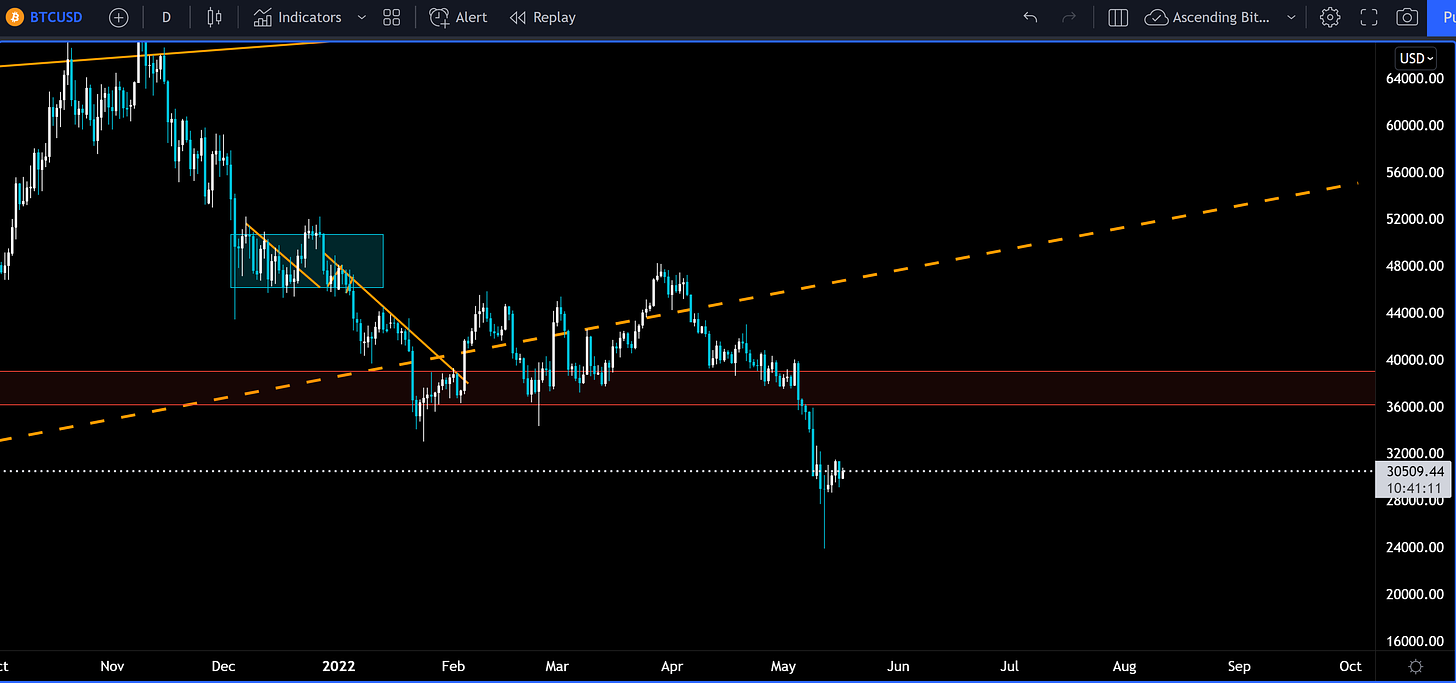

BTC Outlook

You can see that orange dashed line that shows the multi-year uptrend BTC was trying to grasp onto for the first half of 2022. After nearly four months of attempting to hold this line as support sellers overwhelmed any remaining bulls and the price fell drastically. The 20-month moving average did not act support and BTC is now in its 8th red weekly candle in a row (7 have closed, this week is still open).

Everyone is now desperate to know the answer to the same question: Where in the bottom? Well, certainly the wick down on May 12th is a clue. Buyers came in very quickly and took the price back to $30k. We don’t think there is a need to be in a hurry here. If you are looking to pick up a long timeframe spot position then patient cost averaging is still a viable strategy here. The bottom could be in just as easily as a trip down to $16k is possible. As to possible short term targets for a relief rally, the Fibonacci retracement at $36k coincides with a gap left in the CME Bitcoin Futures chart. There will likely be plenty of scalping and swing trading opportunities in the coming week.

Possible Course of Action

Long under $30k expecting to fill the CME gap at $36k

Do nothing and wait for further consolidation

Short any weakness looking for short term trades

The Bulls’ Defense:

Bounce off $30000 big round number

The Bears’ Prosecution:

Global macro uncertainty

Bear flag broken down

ETH Outlook

That deescalated quickly! We have been following this bull flag that had been forming in the ETH/BTC chart and just like most cryptos when the bull flag extends to far horizontally after failed breakouts it gives back all the gains rapidly. Many describe this chart pattern as a Bart, because of it’s resemblance to the shape of Bart Simpson’s head. We had been a little confused because ETH was holding strong against BTC in this recent sell off but finally the market caught up with it. We are now back to our usual pattern of BTC selling off results in ETH selling off faster. Note that ETH is still 90% correlated with NASDAQ. The play still seems to be treating ETH like a high beta tech stock. When a relief rally occurs, expect ETH to be leading the pack.

Possible Course of Action

Caution here as ETH is highly correlated with the tech stock sell off

Wait for further consolidation and confirmation of a higher low

If you want to be long BTC, you can be long ETH for more beta

The Bulls’ Defense:

EIP-1559 has burned $4,944,771,767 (2,342,683 ETH) so far. Supply constraints should continue to have a positive impact on price.

The Bears’ Prosecution:

Global macro uncertainty

Nasdaq correlation and sell off

Want more from Foot Guns? More podcasts, daily cheat sheets, defi guides and access to our private discord channels.