It Didn't Go To Zero

Tim Draper calls for $250,000 BTC in 2022. That probably what happen either.

We just released our latest Private Podcast where Hal and Boomer discuss the current health of the American consumer and how they are positioning going into June. Available to Premium Subscribers only.

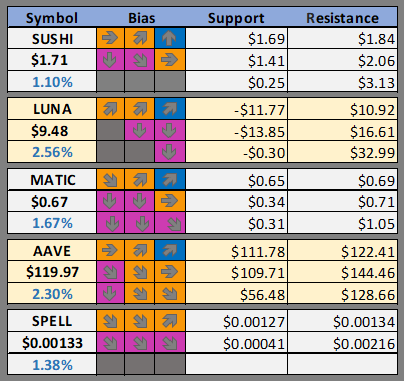

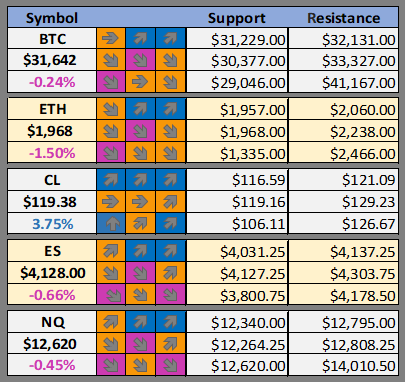

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, ETH, OIL, ES, and NQ as well as our favorite altcoins.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Polkadot’s Moonbeam Adds Liquid Staking Giant Lido (CoinDesk)

Fireblocks Hires Former Bank of England Fintech Chief to Lead CBDC Efforts (CoinDesk)

UK Government Proposes Stablecoin Safeguards After Terra Collapse (CoinDesk)

BNB Chain releases year-long technical roadmap to develop ecosystem (CoinTelegraph)

India cooperates with IMF on crypto consultation paper (CoinTelegraph)

Singapore to explore digital asset tokenization on public chains (CoinTelegraph)

All Terraform Labs Staff Subpoenaed as Investigations Ramp Up (Blockworks)

JPMorgan: Crypto Trumps Real Estate As ‘Preferred Alternative Asset Class’ (Blockworks)

Tether’s Stablecoin Launches on Polygon to Support ‘Historical Growth’ (Blockworks)

Ethereum’s Ropsten Test Network Ready for Merge ‘Dress Rehearsal’ (Decrypt)

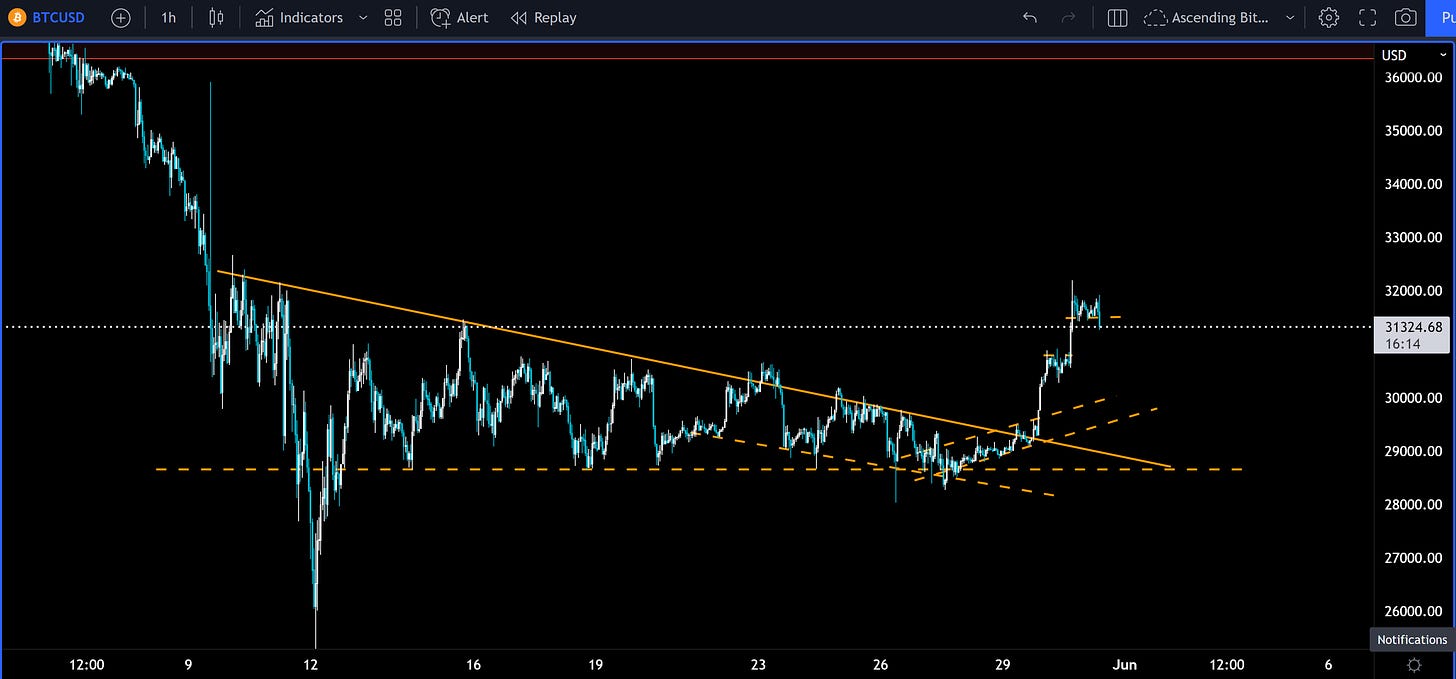

BTC Outlook

It is fairly clear which direction Bitcoin is going after consolidating for nearly a month in the high $20ks. The question now becomes, can this rally persist? So far Bitcoin has broken out from this trend of lower highs and is now stepping upwards. However, this morning started with a breaking of the short term consolidation and downward price movement. We are thinking BTC will move to retest the CME gap left at $36k. However, the path in which it gets there is unclear. It would not be surprising to see BTC fall back below $30k again to rest the strength of buyers before finally making a move to $36k.

Buying the dip could be working again.

Possible Course of Action

Long under $30k expecting to fill the CME gap at $36k

Do nothing and wait for current breakdown to consolidate

Short here looking for a retest of $30k

The Bulls’ Defense:

Breakout of month long consolidation

The Bears’ Prosecution:

Global macro uncertainty

Tech stock correlation

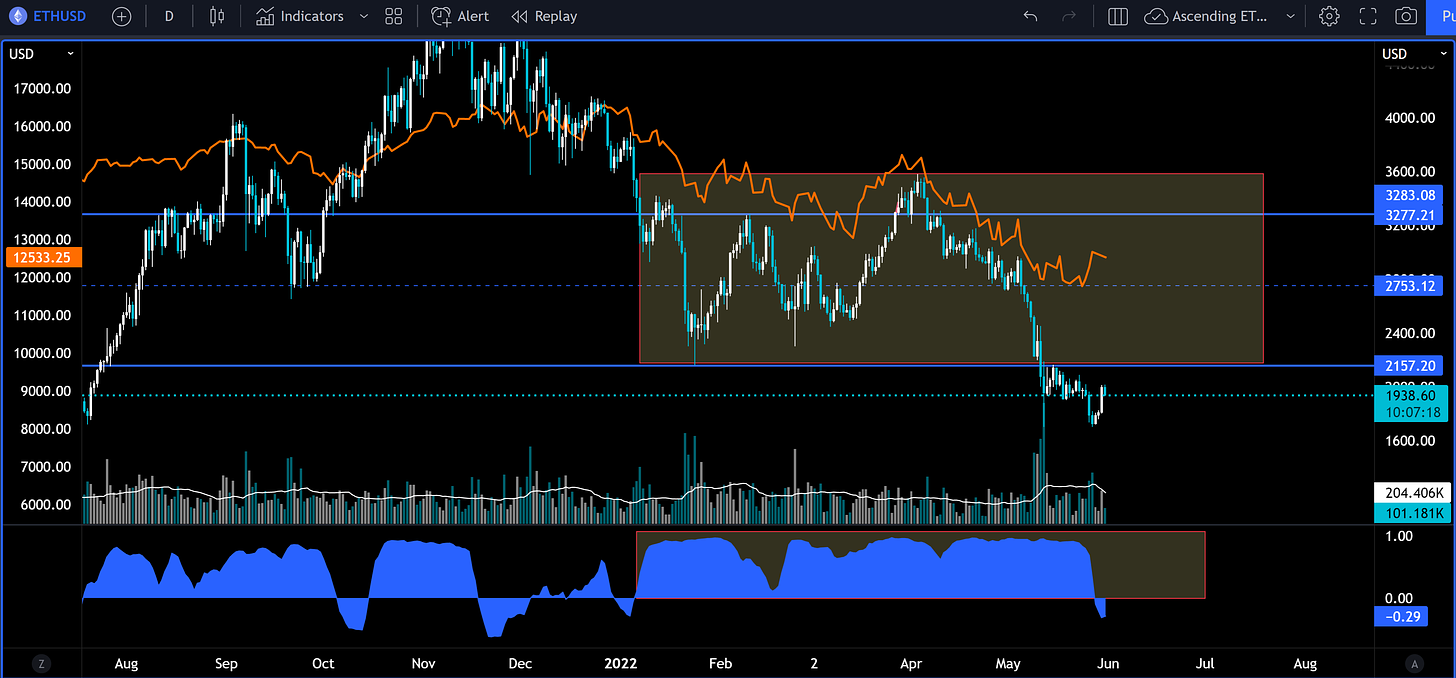

ETH Outlook

Well, the NASDAQ and ETH coefficient broke, but in the lamest way possible. The orange line shows the NASDAQ and you can see that even though the daily coefficient (in blue on the bottom) fell to 0 and even went slightly negative that actual shape of the price distribution is not drastically different. ETH ended up rallying just like NASDAQ it was just late to the party, or in this case waiting for Memorial Day Weekend to party. For now crypto continues to take its cues from the stock market and specifically tech stocks. It is looking like the correlation will return in the coming weeks regardless of the price direction.

Possible Course of Action

Caution here as ETH is highly correlated with the tech stock sell off

Wait for BTC to rise above 50-day MA before long ETH

Short ETH/ long BTC might work (well it did this morning!)

The Bulls’ Defense:

EIP-1559 has burned $4,226,383,605 (2,364,940 ETH) so far. Supply constraints should continue to have a positive impact on price.

The Bears’ Prosecution:

Global macro uncertainty

Nasdaq correlation and sell off

ETH/BTC pair continues to be weak

What are you doing with your LUNA? Everyday in our Premium Discord we're discussing what to do with LUNA. Shit some of our members are buying it! If you have LUNA you should probably upgrade to Premium now so we can navigate this shit storm together.