Want more from Foot Guns? Subscribe to become a premium member and get more podcasts, more updates and access to our private channels in discord were we actively discuss trade ideas.

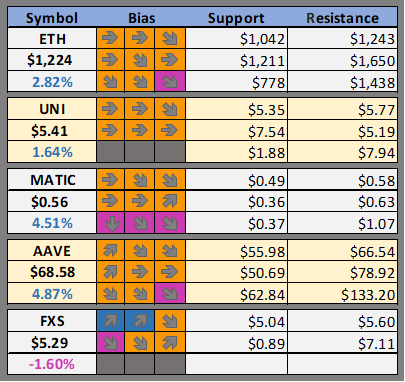

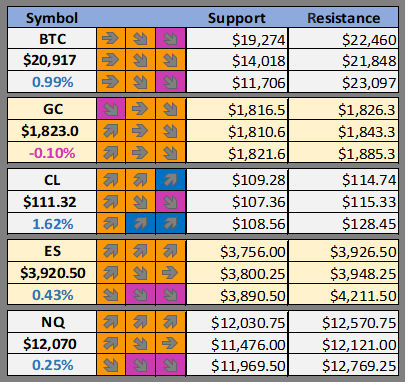

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, GOLD, OIL, ES, and NQ as well as our favorite altcoins.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Crypto exchange Huobi says layoffs are a 'possibility' (The Block)

Lebanon’s university students turn to crypto to avoid hyperinflation (The Block)

Solana's developers unveil web3-focused mobile phone (The Block)

Ledger Live Adds Yield Earning Capability Via Alkemi Earn (CoinDesk)

Morgan Creek Is Trying to Counter FTX’s BlockFi Bailout (CoinDesk)

Luxor Launches Hosting Marketplace for Bitcoin Miners (CoinDesk)

Tether CTO refutes stablecoin FUD as short-sellers circle (CoinTelegraph)

Unizen ‘CeDeFi’ platform secures $200M investment from GEM (CoinTelegraph)

FTX Cuts Down Claims That It Plans To Acquire Robinhood (Blockworks)

Celsius Clashes With Lawyers Over Chapter 11 Bankruptcy (Blockworks)

SEC Chair Again Says Bitcoin Is Not a Security. What About Ethereum? (Decrypt)

Who’s Firing—And Still Hiring—During the Bitcoin Bear Market (Decrypt)

As Tether Faces Billions in Redemptions, USDC Is Gaining Ground (Decrypt)

BTC Outlook

Bitcoin’s volatility has been diminishing for the past week as consolidation continues near $20k. This is a bad sign for the bears, but not really something for the bulls to get too excited about. It means the sell off has lost its steam for now. The likelihood is low that tomorrow will be the day BTC goes back to $17k. However, if the price does go back below $20k then expect $17-$18k to be retested and if any daily candle closes below $17k strap on your shorts because $15k will come quick. With volatility this low it can be useful to have tight stop losses whether you are short or long because once the price starts moving you don’t want to be on the wrong side of it. $20k looks like a good entry if you are bullish and $22k is a good place to put some shorts if you are bearish. Waiting for a breakout and then bidding into whichever direction it goes is also a viable option here.

Please join us in our discord where we discuss active and potential trades.

Possible Course of Action

Long spot here

Do nothing and wait for breakout or breakdown

Short near $22k looking for retest of $20k ($17k)

The Bulls’ Defense:

Holding $20,000 as support (big round number)

The Bears’ Prosecution:

Global macro uncertainty

Tech stock correlation

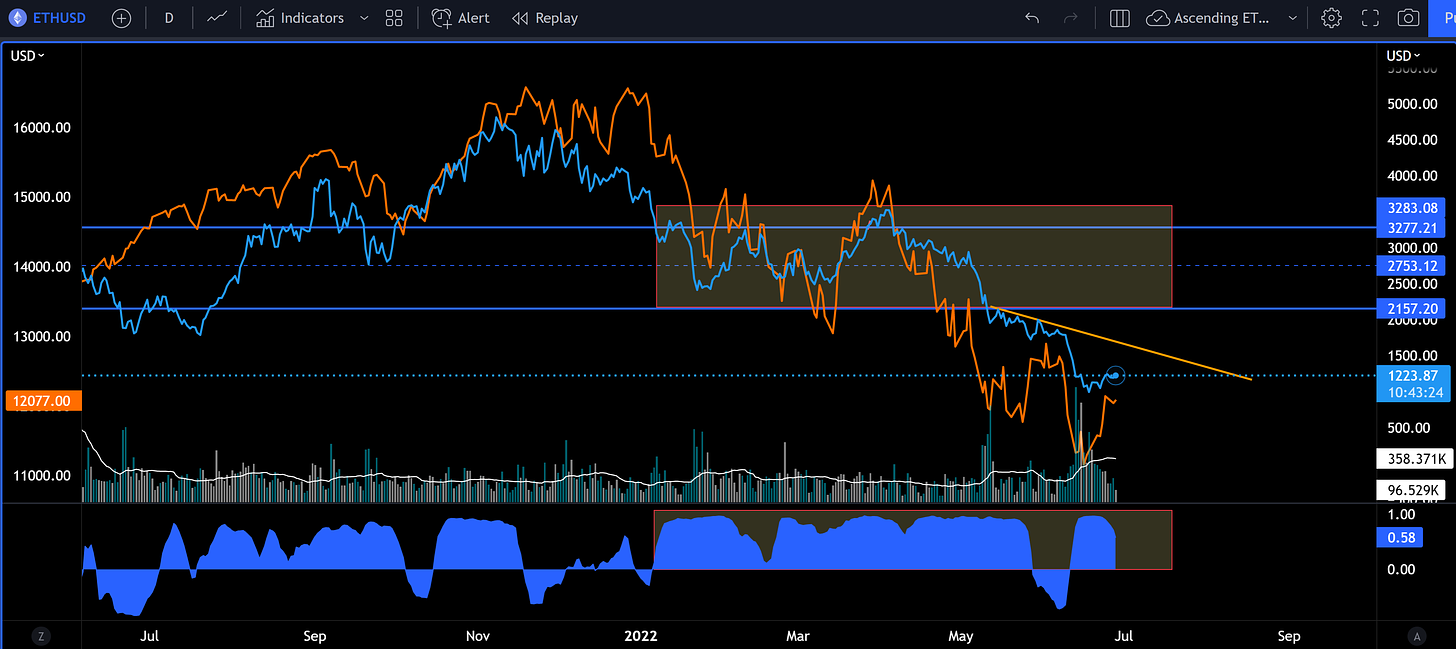

ETH Outlook

We continue to watch the ETH/NASDAQ correlation for signs of it reducing or flipping negative. Though, the last two times the ETH/NASDAQ correlation broke it was a bit of a non-event. ETH and NASDAQ ended up staying correlated on higher times frames they just stopped moving at the exact same moment. The recent correlation peaked on June 22 when NASDAQ started to rally and ETH just continued sideways. This is a sign that market participants are starting to consider the differences in these two assets. There is some possibility that ETH’s recent down pressure comes from forced selling by the large funds that have been margin called. Also, miners may be forced to sell to pay the bills if they did not take enough profits over the last year. With crypto down so much many investors may view NASDAQ as a safer bet than ETH at this moment. A bearish retest of $1500 for ETH seems probable, and NASDAQ out performing ETH seems likely as well over the near term.

Possible Course of Action

Caution here as ETH is highly correlated with the tech stock sell off

Wait for BTC to rise above 50-day MA before long ETH

Long here expecting a retest of $1500

The Bulls’ Defense:

EIP-1559 has burned $3,056,882,714 (2,493,908 ETH) so far. Supply constraints should continue to have a positive impact on price.

ETH 2.0 launch

The Bears’ Prosecution:

EIP-1559 ETH burn has slowed down due to low network usage

Global macro uncertainty

Nasdaq correlation and sell off

ETH/BTC pair continues to be weak

Want more from Foot Guns? Subscribe to become a premium member and get more podcasts, more updates and access to our private channels in discord were we actively discuss trade ideas.