The Merge Draws Near

Ethereum's merge is just around the corner. What does this mean for crypto?

Want more from Foot Guns? Subscribe to become a premium member and get more podcasts, more updates and access to our private channels in discord were we actively discuss trade ideas.

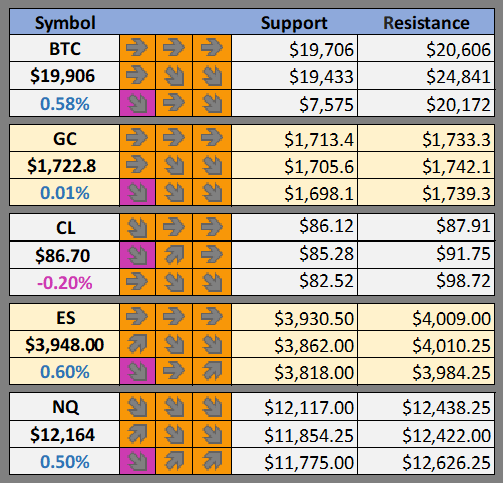

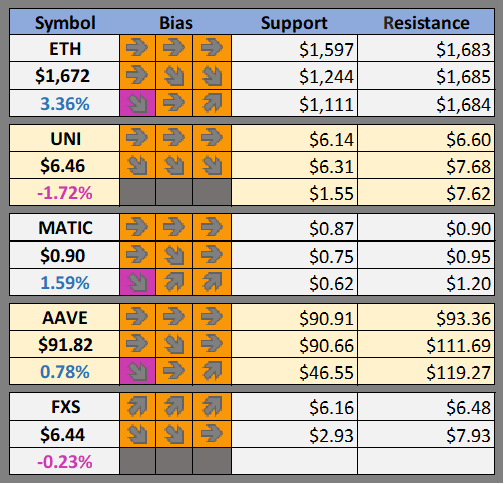

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, GOLD, OIL, ES, and NQ as well as our favorite altcoins

New here? Learn how to read the cheat sheet.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Ethereum activates Bellatrix upgrade as last step before The Merge (The Block)

21Shares parent company raises $25 million at $2 billion valuation (The Block)

Harry Styles and Adele's record label files trademarks for NFT-backed media (The Block)

Three Arrows Capital Wallet Removes $33M of Staked Ether From Curve Pool (CoinDesk)

DeFi Giant Aave Stops Loaning Ether Ahead of Ethereum Merge (CoinDesk)

Crypto Exchange Binance Hires Former Brazilian Central Bank President as Adviser (CoinDesk)

Bitcoiner sentenced to federal prison warns users involved in OTC trading (CoinTelegraph)

Binance To Rename All Stablecoin Holdings to BUSD (Blockworks)

Roche Freedman Defends Bitfinex, Tether Market Manipulation Suit (Blockworks)

Crypto Lender SALT in Buyout Talks, 2 Years After SEC Settlement (Blockworks)

KlimaDAO Engages Tusk Strategies to Push Congress to Write DAOs Into Law (Decrypt)

FIFA Launches NFT Platform on Algorand in Run-Up to World Cup (Decrypt)

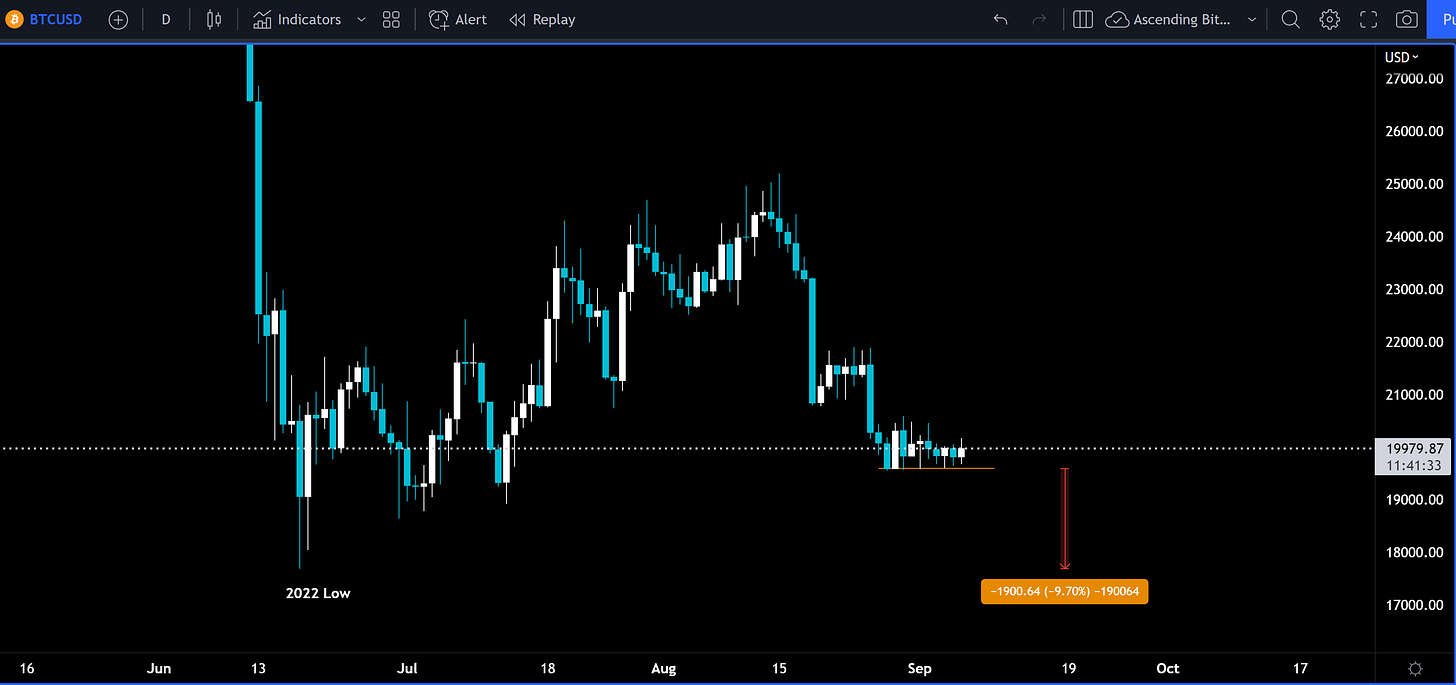

BTC Outlook

Traders, Investors, and Bitcoin HODLERs are waiting to see if Bitcoin can put in a higher lower in this recent sell off. There is now only about a 10% decline before Bitcoin retests the yearly low just under $18,000. It’s possible that the ETH merge is a boon on the price and the only reason a new low has not been made. However, it is also possible that the ETH merge is suppressing the Bitcoin price as more sophisticated market participants are using Bitcoin as a hedging tool.

One thing to note is so far this past weeks consolidation has sustained longer than the previous consolidation in the second to last week of august. There is also a flatness to the consolidation that gives some probability that this is in fact a higher low.

Looking back at last tuesday’s newsletter and the price has not bugged. Once $19500 or $20500 break it is likely the price will continue in that direction. With a 10% decline to the yearly low it is possible many will see this as a buy in opportunity and strength will finally be found moving the price higher.

Please join us in our discord where we discuss active and potential trades.

Possible Course of Action

Do nothing and wait for price to move above $20.5k (get long)

Do nothing and wait for price to move below $19.5k (get short)

The Bulls’ Defense:

Potential Higher Low (Show of Strength)

The Bears’ Prosecution:

Failure to hold $20.5k now acting as resistance

A Closer Look

This section will be focused on taking a closer look on what Hal thinks is important to watch in the coming week.

Today we’ll continue to follow the merge narrative. Because the merge is on the top of everyone’s minds we will be following the price action closely as September 15th draws near.

Keep reading with a 7-day free trial

Subscribe to Foot Guns to keep reading this post and get 7 days of free access to the full post archives.