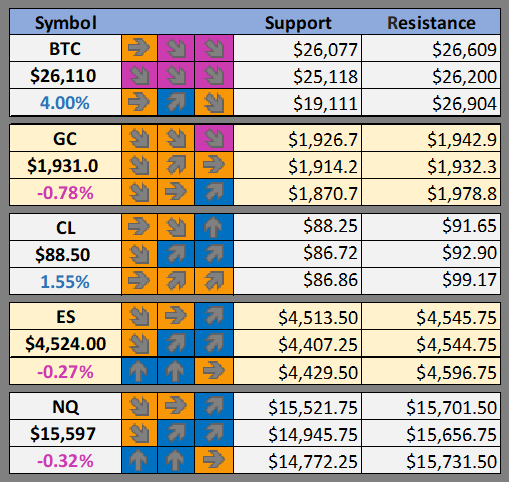

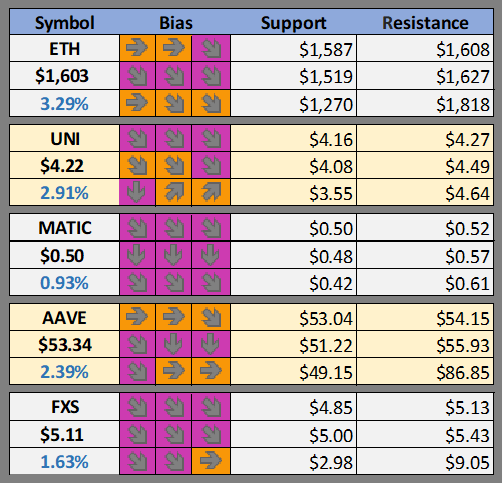

Cheat Sheet -

Current support and resistance ranges plus our bias on top cryptos, oil, and stocks.

Are you new to Foot Guns? Learn how to read the cheat sheet here.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Hyped Telegram bot Banana Gun's team dumps treasury after token bug (The Block)

SEC Chair Gensler stays the course in push for crypto compliance ahead of Tuesday hearing (The Block)

Meta is building an AI model to rival OpenAI’s most powerful system (CoinTelegraph)

Bitcoin UTXOs echoing March 2020 ‘black swan’ crash — New research (CoinTelegraph)

Bitcoin Short Squeeze Lifts Prices Back to $26K (CoinDesk)

Binance Says SEC’s Request for Depositions is ‘Overbroad’ and 'Unduly Burdensome' (CoinDesk)

SEC’s Peirce: The US government needs to remember who it represents (Blockworks)

Plunge in crypto market volumes bleeds into September (Blockworks)

Flatcoins 'New Thing On the Horizon': Coinbase CEO Brian Armstrong (Decrypt)

Swan Bitcoin’s custodian now owned by Ripple — but execs have major beef (Protos)

UK-registered crypto scam stole $76M from Thai investors (Protos)

Vitalik Buterin’s Tornado Cash alternative and yet another DeFi rage quit (DLNews)

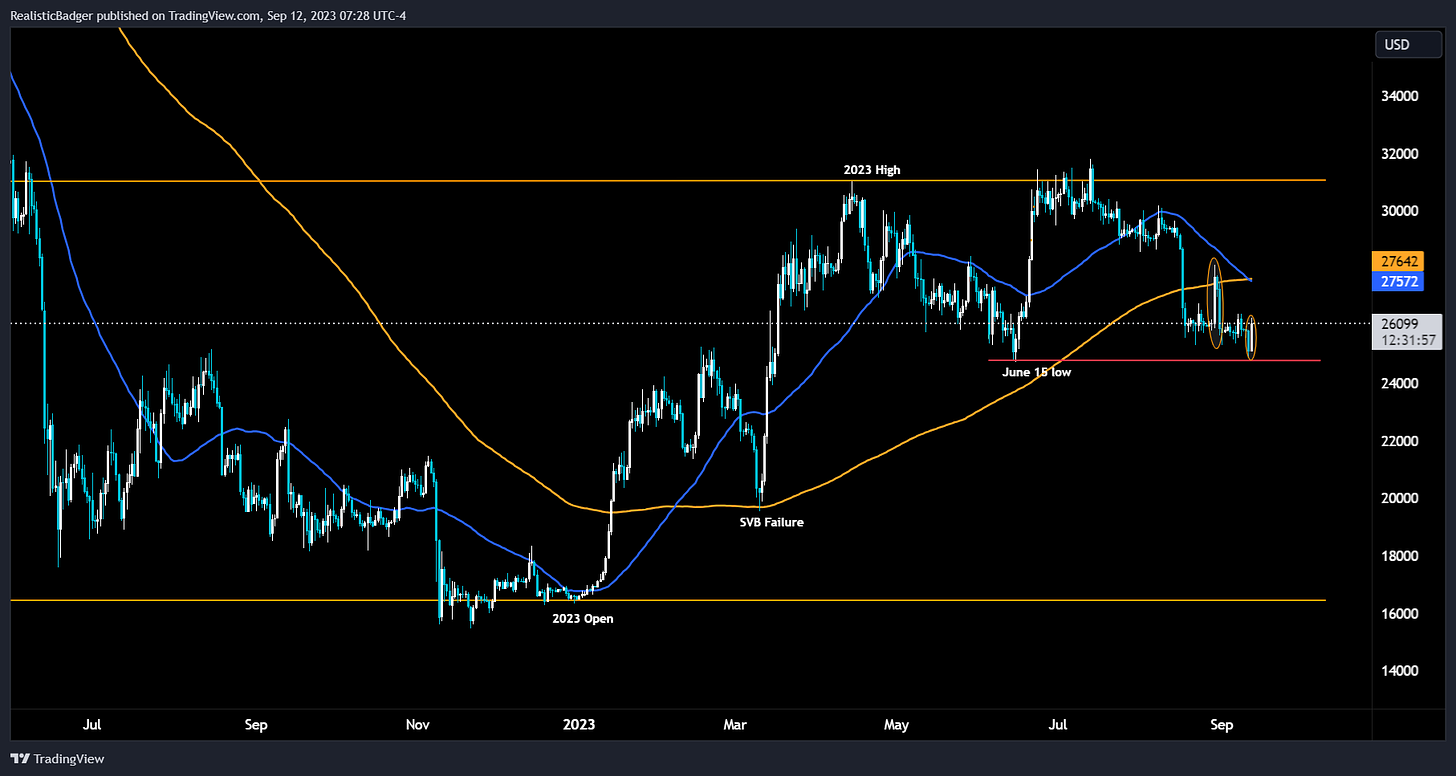

BTC Outlook

The pattern that seems to be forming around this consolidation is a rejection of anything that isn’t $26,000 BTC. Over the last two weeks several attempts to breakdown or breakup have resulted in a complete retrace within the next day or two. Yesterday, BTC fell through the bottom of the recent consolidation and many one crypto twitter were calling for continuation and a move down to $22k or even $20k. However, over night BTC completely retraced the selling and is now trading back at the same level it was two weeks ago around $26k.

It appears market participants are using a microscope to judge the price. This means that rather than focusing on longer term directions and fundamentals many are hyper focused on intraday moves. This combined with the use of leverage creates these short lived price swings. It should be expected that this behavior will continue until the spot market picks up in volume. As was stated in last weeks newsletter the market is waiting for some catalyst to kick off the spot market volume. This could be an ETF approval, some change in fed behavior, the halvening in 2024 summer, or some unforeseen event.

Until then the price is likely to trade between important levels such as the 200 day moving average which is now acting as resistance, and as of yesterday the price appears to have bounced near the Summer low as support.

Join us in discord where we will actively be following Bitcoin’s price action.

Possible Course of Action

Do nothing, remain flat and wait for price to rise above 200 day MA or below June low

If short stay short while price remains below 200 day MA

DCA into spot long over next 6 months in anticipation of Halvening

The Bulls’ Defense:

ETF decision could still happen in 2023

price held June low as support

The Bears’ Prosecution:

price trading below 200 day MA

price rejected 200 day MA (flipped to resistance)

Want more from Foot Guns? Join our Discord where we have live conversations about the market.