Want more from Foot Guns? Subscribe to become a premium member and get more podcasts, more updates and access to our private channels in discord were we actively discuss trade ideas.

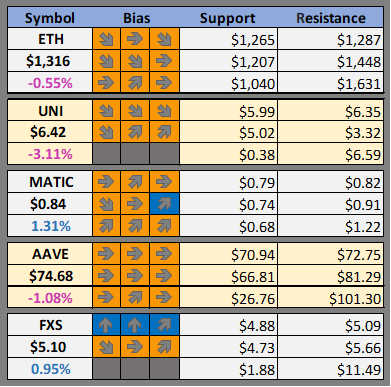

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, GOLD, OIL, ES, and NQ as well as our favorite altcoins

New here? Learn how to read the cheat sheet.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Google and Coinbase partner on plan to offer crypto payments for cloud services (The Block)

CNN offers holders partial refunds as it suddenly shutters NFT Vault (The Block)

Hacker drains $2 million from QANplatform bridge, token slumps 94% (The Block)

Blockfusion's Crypto Mine in Niagara Falls Shut Down Due to Zoning Ordinances (CoinDesk)

BNY Mellon Starts Crypto Custody Service (CoinDesk)

OECD Releases Framework to Unify Global Crypto Tax Reporting (Blockworks)

Coinbase Secures Crypto Payments License in Singapore (Blockworks)

Enormous Multi-Sig Transaction Briefly Crashes Bitcoin’s Lightning Network (Decrypt)

G20 to Review Crypto Regulation Framework This Week (Decrypt)

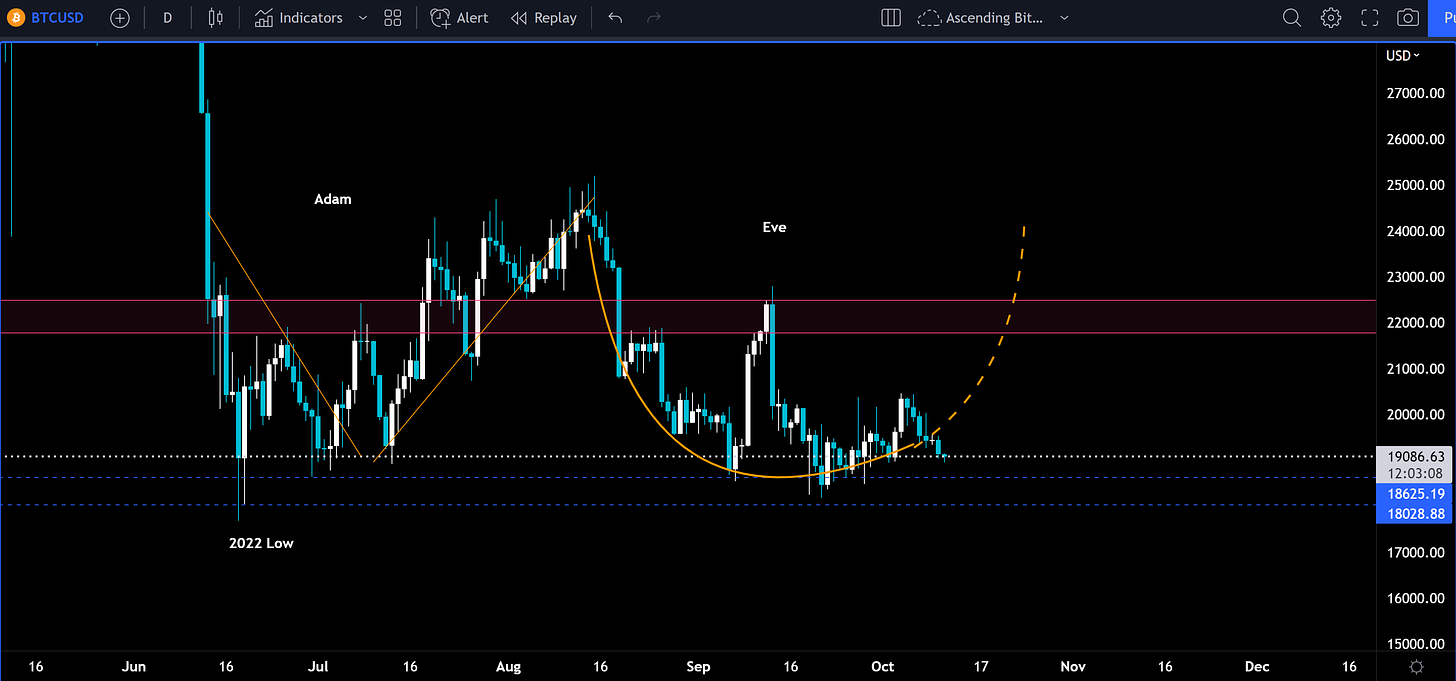

BTC Outlook

We continue to watch and see if BTC can complete this rounded bottom to form a potential double bottom low. Well the short term direction is certainly heading the wrong way. For seven downs down BTC is drifting lower, but also note that volatility is squeezing with the last seven daily candles having a much tighter range than compared to most of the other days since June.

We want to deploy two stop loss concepts here: a time stop and a price stop. For a price stop, if you were to get long here with a target of $22k and a price stop just above the yearly low at $18000 this represents about a 3:1 risk reward. Another way to manage the risk of the position is a time stop. Looking at the dashed orange line above, we are looking for BTC to make a relatively fast price rise. The orange dashed line intersects with the Fibonacci retracement (red box) in about 14 days. So, probably after 5-10 days if the price is not closely tracking this expected path that could be a stop loss signal. Basically, what is it you are expecting to happen and in what ways is the thesis invalidated.

Here’s a similar take from another trader that calls for wider volatility swings.

Ah, the CPI print this Thursday! We think the same play book from last month will work :

If CPI report beats expectations buy (less inflation than expected)

If CPI report misses sell (more inflation than expect)

Expect some big short term swings on Thursday morning.

Please join us in our discord where we discuss active and potential trades.

Possible Course of Action

Long here expecting a retest of $25k

Hold if already long (potential stop loss under cheat sheet support)

Short if $18600 fails to hold as support

The Bulls’ Defense:

Higher Low (Show of Strength)

Potential Adam and Eve forming

The Bears’ Prosecution:

Price still not holding $20k as support (big round number)

Short term (7 days) of negative price action

A Closer Look

This section will be focused on taking a closer look on what Hal thinks is important to watch in the coming week.

Today we’ll look at two altcoins Hal has been following closely and discuss possible entries to watch out for in the coming month.

Keep reading with a 7-day free trial

Subscribe to Foot Guns to keep reading this post and get 7 days of free access to the full post archives.