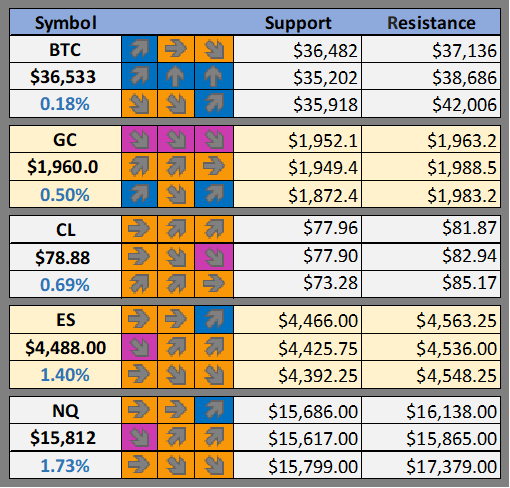

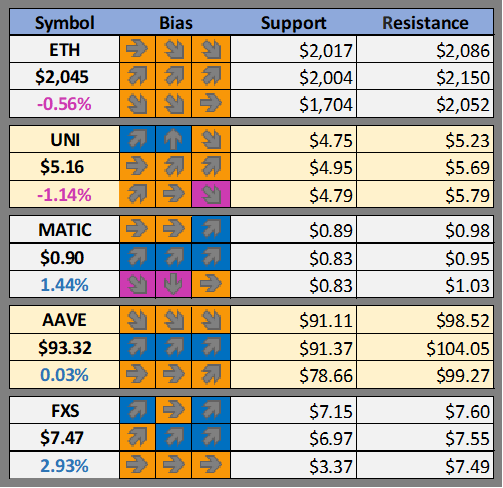

Cheat Sheet -

Current support and resistance ranges plus our bias on top cryptos, oil, and stocks.

Are you new to Foot Guns? Learn how to read the cheat sheet here.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

dYdX Chain trading goes live, enters beta mainnet stage following governance vote (The Block)

Reddit admins set to reduce moons supply by over 30%, token surges 240% (The Block)

Bithumb plans to be first crypto exchange listed on Korea stock market: Report (CoinTelegraph)

Swan Bitcoin to terminate customer accounts that use crypto-mixing services (CoinTelegraph)

CPI Report Tuesday Could Provide Next Bitcoin Catalyst (CoinDesk)

XRP Futures Traders Nurse $7M Loss as BlackRock ETF Rumor Causes Wild Price Swings (CoinDesk)

Interoperability isn’t just a buzzword (Blockworks)

Raft Finance floats user bailout plan after odd exploit (Blockworks)

US Could Kill DeFi Unless IRS Changes Course on Tax Rules: Blockchain Association (Decrypt)

Genesis settles with 3AC to pay 96.7% less than the $1B it claimed (Protos)

Binance co-founder sticks by CZ as other execs walk — who is former TV host Yi He? (DLNews)

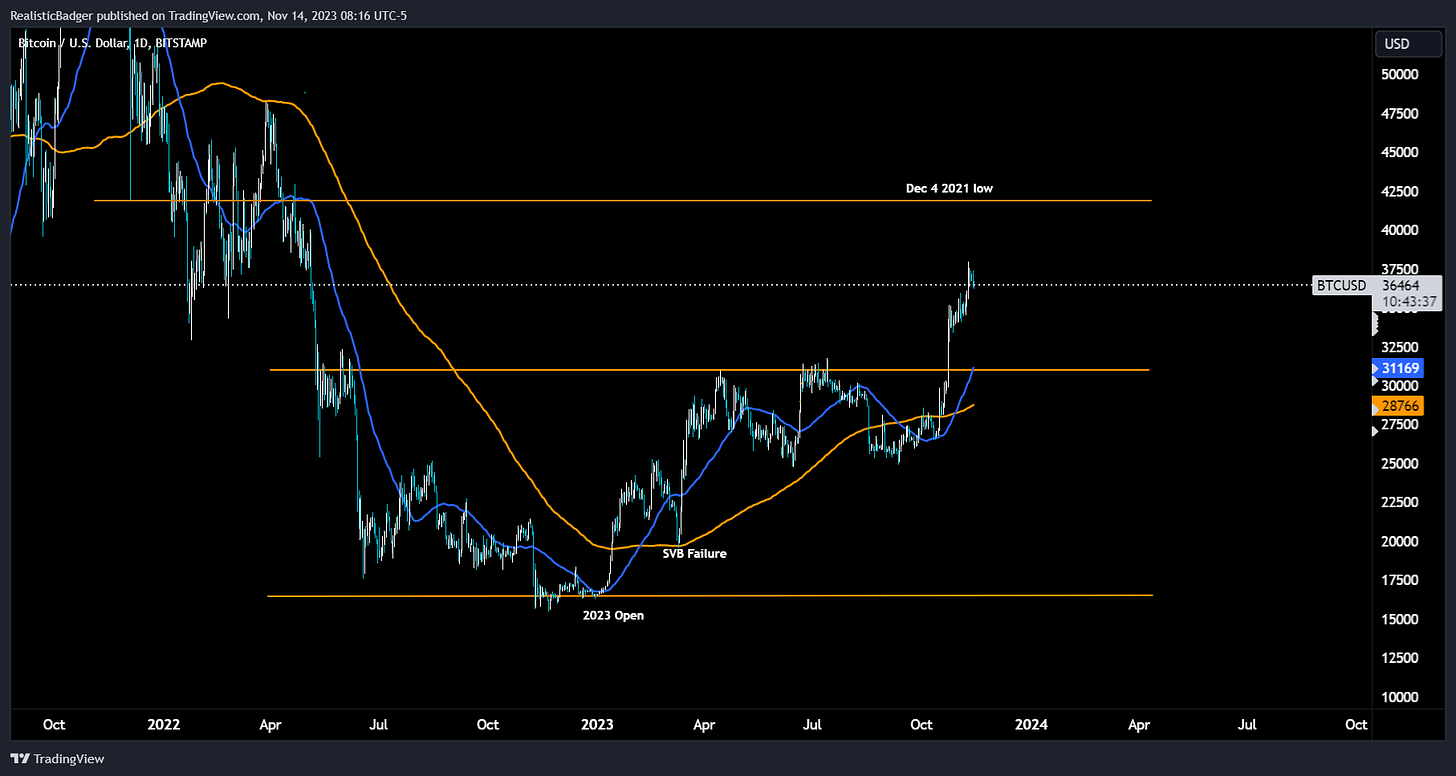

BTC Outlook

The Nasdaq rallied and US Treasury yields fell on the news that CPI numbers came in under the estimated values. Bitcoin’s price relatively did nothing. The volatility around the CPI prints in the Bitcoin market have dwindled compared to 2022 where large intraday volatility followed the news. It’s still possible Bitcoin could rally later today in sympathy with tech stocks in the expectation that the fed may cut rates sooner than people were expecting. However, the intraday volatility remains low and near a bottom compared to the past month of trading.

Looking at the technical indicators, the 50 day moving average has now crossed above $31,000. This is near where Bitcoin’s price rally had stalled out twice previously this year. It becomes more likely now that Bitcoin’s price will continue to trade between this ~$31,000 to ~$41,000 range because we would expect any sell offs to first find support at the 50 day MA. The price has strong momentum and will likely continue to rally until the Cheat Sheets weekly bias flips to neutral at that point one would expect the weekly support will hold on the first retest (around $35,000).

Join us in discord where we will actively be following Bitcoin’s price action as well as other markets including equities, altcoins, and commodities.

Possible Course of Action

Stay Long here while price remains above 50 day MA

Short if price falls below 50 day MA

DCA into spot long over next 6 months in anticipation of Halving (2024 summer)

The Bulls’ Defense:

ETF decision could still happen in 2023

Golden Cross of 50day and 200 day MA

CPI numbers below expectations

The Bears’ Prosecution:

Consolidation could retest $35k

Want more from Foot Guns? Join our Discord where we have live conversations about the market.