Don’t miss last weeks private podcast!

Hal and Boomer discuss their short-term outlook on crypto and broader markets, and Hal laments being blocked by Will Clemente (one of his personal heroes) on Twitter.

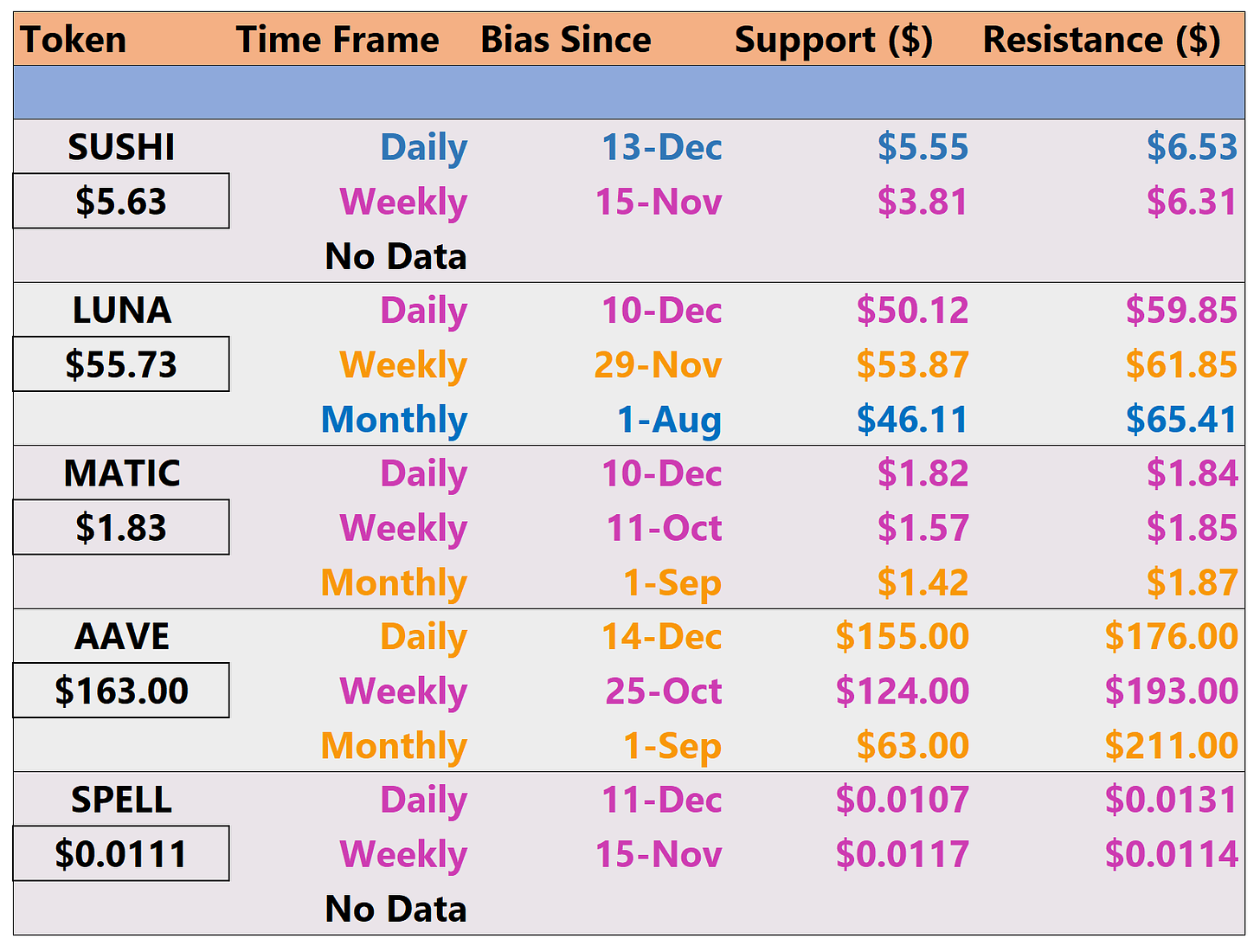

CHEAT SHEET

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Are you buying these tokens? Did you read our guide on how to buy them on Sushiswap and Uniswap? Got questions? Leave them in the comments.

The Decentralized Reserve Currency

Crypto News

Tim Cook discusses crypo and NFTs saying he owns crypto.

Breaking News: Germany's Biggest Bank Is Offering Bitcoin Now!

Adoption, Scarcity to Fuel a Bitcoin Run to $100K: Report -Nasdaq

Finally a real story!

$300,000 Bored Ape NFT sold for $3,000 because of misplaced decimal pointAnnouncing the Client Incentive Program -Ethereum Foundation

BBVA Switzerland Becomes First Traditional Financial Institutions In Europe To Add Support For Ethereum

Bitcoin Outlook

Blame for the bearish price action, as usual, landing on FTX’s CEO SBF or CEO of Alameda Sam Trabucco (we have a theory SBF is just the other Sam in a wig). Anyways.. Many are now turning against crypto saying all the smart money wont place a bid. Our very own Boomer said the same thing on the phone to me last night, and he doesn’t use fancy crypto spy tools to watch what crypto wallets are doing (like nansen). I also joined a twitter space like night where the leaders in the space were bragging about some secrete knowledge that there was no bid on Bitcoin and that the altcoin bids were even further down.

Okay, Boomer. Okay, Onchain Zoomers. I am just a bit skeptical when I get the same sentiment three times in three different ways. Look at the chart anyone can see that there’s been more selling than buying in the last 30 days. If you’ve been in crypto since Jan 2021 then you can make an educated guess that alts coins will sell off harder than Bitcoin.

Bitcoin buyers all wanted out above $60k, nobody new wanted back in, and now we are around $50k and some buyers are currently failing to keep the price there. Look at the chart again and you’ll see that below $60k all the smart money (including me) was trying to catch short term runs back at $60k, but no one with a long term mind frame wanted to come in with a real bid.

Then at some point the traders didn’t see an opportunity any more because it was obvious no bids were coming in so they all left, and when they left there was no long term buyers so we zoomed down to $50k. And I guess no one was awake or cared to press the buy button and BTC wicked to $30k-$45k depending on the exchange. Then everybody woke up was like “oh ooops I was supposed to buy at $45k, yolo buy the dip” and now the situation is again just a handful of traders trying to capture some return on bids back to $50k. Now, I think we get one more shot at $50k, but if Santa Claus doesn’t “come to town” then that’s probably it for a bit and we do the whole show over again at $40k, $30k, etc.. until the more long minded buyers decide they like BTC again as a multi-year trade/investment.

This is certainly sounding bearish. So, what to do? Leverage sounds bad here. No one has a strong feeling about a bull run continuing, but it’s dangerous to short any bottom (in the mid term trend). Obviously, if you realize the money you put into crypto would have been better for buying shoes then there’s no better time to sell than now. Just when you sell go get the shoes! But if you are holding spot BTC and you got nothing better to buy. (I mean, we all know you aren’t going to go buy treasury bonds no matter what the Fed says this week.) Then doing less is more here. Just go outside and walk away from the computer.

Oh and this guy has great BTC takes.

Possible Course of Action

Go outside

Read more Foot Guns articles

Try this trade back to $50k

Pick up a short near $50k if it doesn’t hold looking for a retest of $40k

The Bulls’ Defense:

Reclaiming $50k and holding as support would be a show of strength and an indication that buyers have returned to the market

The Bears’ Prosecution:

Multi-week downtrend could continue. $50k has been rejected multiple times. $40k would be next major support. Based on recent price action it’s possible $30k is wicked to again on some exchanges.

ETH OUTLOOK

ETH’s price action has become a hot mess.

This is a quote from last weeks’ FootGuns TA. The big wick down on Dec 3rd was the clue to take a break, and to be fair I think a lot of people got faked out on the rally on Dec 12th. The price action is horrible and this is a dangerous place to be trading.

Here’s the range we are suggesting : $3450 - $4200. You can always look to the cheat sheet, but without that there’s not a lot of directional bias in this chart outside of the range. As long as ETH is trading above $3450 and below $4200 it will probably continue to chop aimlessly.

Until the current pattern breaks eyes on the cheat sheet, and according to that the bias is still bearish. That would mean if we continue going down $3450 is likely to be retested.

Possible Course of Action

Do nothing

If you want to short we’d recommend waiting for a failed retest of $4200

Could look to open a long near $3450

The Bulls’ Defense:

EIP-1559 has burned $4,549,150,296 (1,187,396 ETH) so far. Supply constraints should continue to have a positive impact on price.

The Bears’ Prosecution:

Potential macro double top that could result in multi-week (or month) consolidation

Please don’t forget to like (heart button at bottom) and share this post!