Step 1 - Investment Thesis

Before you run off and throw your money in the trash by buying a shitcoin you hardly understand take a step back, breath, and explain to another human what you are about to do.

On Dec 3rd, 2020 I (Hal) was eligible to claim Badger tokens in an airdrop because of various things I had done in DeFi, like providing liquidity on different swap protocols. Immediately (airdrop forcing me into a trade I didn’t understand violated Step 1), I sold half of the airdrop, and started to research BadgerDAO to build a thesis.

I heard an AMA with Badger’s creator where he explained that Badger would “Bring Bitcoin to DeFi”. Being an ultra-extreme-Bitcoin-DeFi-maxi myself, I started contemplating a thesis, joined the BadgerDAO discord, and rebought the tokens I sold after some price consolidation. At the time it was a hopeful promise, I was certainly not about to take my BTC out of my cold-storage and move it into the BadgerApp. Badger was young, DeFi was barely DeFi and I didn’t understand anything I do now about the more complex yield farming strategies of curve.

Hal’s Badger Thesis as of Dec 2020

BadgerDAO - bring Bitcoin to Defi

This means badger should be highly correlated to BTC, ETH. Possibly, could act as a call option on both as any advancements in Badger protocol should compound gains in BTC,ETH. Badger literally earns yield for users using Bitcoin on Ethereum.

Lots of Bitcoiners that will eventually trust Badger after it’s proven with time. The Bitcoiners who decide to earn yield on their BTC will prefer to deposit in Badger than BlockFi once they trust ETH/Badger protocol. This is because BadgerDAO’s protocols allow you to maintain self custody while earning yield, which BlockFi (and other centralized options) does not offer.

Risks -

Small marketcap ~10million at the time (now $360million as of 11/08/21)

Protocols = Bitcoin, ETH, Badger, Uniswap, Sushiswap, (I didn’t write down Curve at the time)

Price/Market risk ( BTC,ETH )

Pickle had been hacked around that time, so I was very focused on protocol risk knowing I could lose 100% of funds. At the time, buying Badger token was safer than using the protocols as a draw down would probably be only 80% vs 100% (ha!). I commend anyone who was an early staker, I came in soon with BTC/ETH but I was caution and no where near the first.

Badger’s protocols has now been live for just shy of a year with no issues. In fact others have copied various parts of Badger’s protocol to build their own products. Code matters in DeFi.

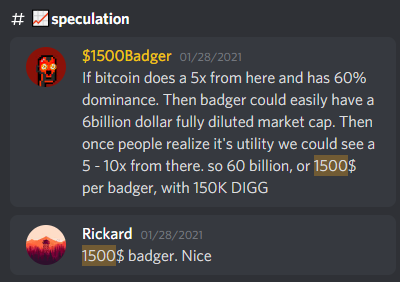

$1500 Badger

Just a month after launch BadgerDAO was taking off, the AUM was rising fast and so was the marketcap of the Badger token. I thought, we need something to shoot at. The Badger discord has always been alive and exciting with many people coming and going. At a month in it was wild and people were saying all kinds of crazy things.

I stared at some charts for a while , mainly BTC price (PlanB stock to flow, some on-chain, etc..), changed my name to 1500$Badger and said this :

.

Yah.. I actually didn’t even realize until writing this article so many people had gotten $1500 worth of Badger in the original airdrop.

Haha, I wonder if poapster.eth knows he was the first person to say 1500 in the Badger discord. (You can go search all this yourself in the BadgerDAO Discord btw, DYOR)

Wow what a journey since then..

So when $1500 Badger?

Well, I just joined the BadgerDAO core team last week to take a direct part in the efforts of stewarding Bitcoin in DeFi to earn safe, reliable yield for users.

DeFi is fun and DAOs are welcoming. You don’t need to buy the token or deposit your funds to participate. Remember, Step 1 - Investment Thesis. Here are some resources to start learning Badger discord, website, podcast, or you know maybe the Foot Guns Discord.