Don’t miss last weeks podcast where Boomer and Hal discuss the current state of the markets and how they are trading it.

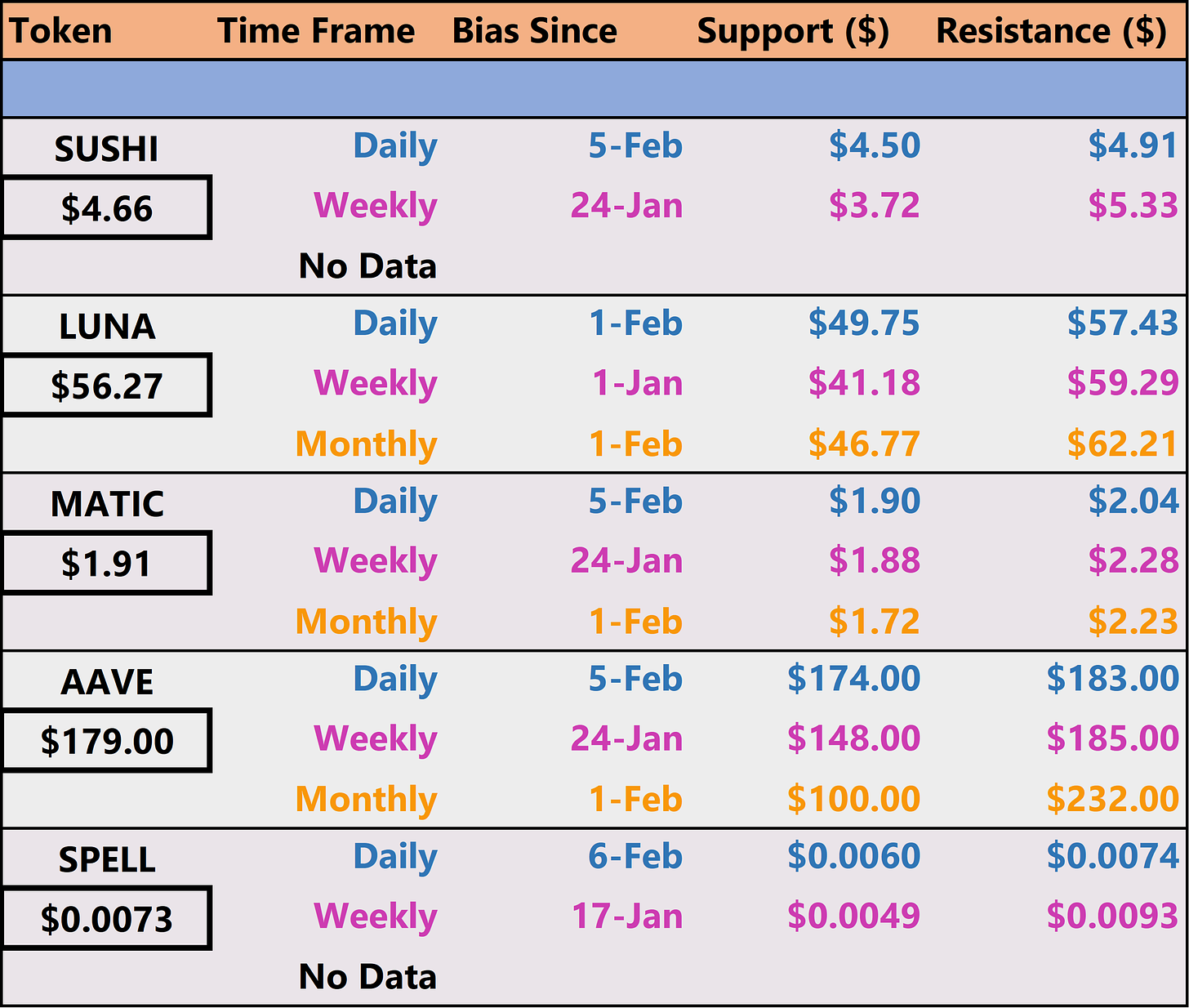

CHEAT SHEET

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Are you buying these tokens? Did you read our guide on how to buy them on Sushiswap and Uniswap? Got questions? Leave them in the comments.

Crypto News

KPMG Canada adds BTC and ETH to its balance sheet (Yahoo Finance)

AssangeDAO Raises $38M to Aid WikiLeaks Founder's Court Battle (CoinDesk)

US Lawmakers Introduce 'Virtual Currency Tax Fairness Act' to Boost Cryptocurrency Use for Payments (Bitcoin.com)

Cash App announced that the Lightning Network can be used for Bitcoin transfers (Bitcoin Magazine)

Singapore records a 13x increase in crypto firms (Cryptopolitan)

Jump Crypto forced to save Solana with $320M bailout of its own company (Protos)

Manchester United Legends to Create World’s First Soccer DAO (Decrypt)

BTC Outlook

The rule of large numbers has held for BTC all through 2021. You don’t need to consider Fibonacci lines or any special indicators. Simple lines drawn at 30k,40k,50k,60k show the story. No one really knows what this thing should be worth and so the price just takes intermediate trips between these large round numbers. If you’ve been reading for a while, you’ll be familiar with this story. I pointed out in December that BTC was hugging $50k with multiple retests and that if the movement above $50k during the final weak in December didn’t hold then surely we would retest $40k. I also pointed out that the way the price wicked through $50k on December could repeat itself and we could see a wick down to $30k.

Well the story goes on. BTC rejected the move down to $30k and is now comfortably back above $40k. We are now recycling the narrative in late December. BTC needs to hold above $40k, make some higher low and head off to retest $50k. So how do you trade it?

Expect the price to range between $38k and $50k for the coming weeks. Holding support and trading sideways tends to be a good signal for a short term altcoin rally. However, there is still a chance altcoin/btc pairs continue to sell off if BTC continues rising at the current pace. It’s as easy as placing bids near $40k and asks near $50k.

Possible Course of Action (advice from last week still holds)

Scale into a long here buying any dips

If long, stay long and look for a retest of $50k

Could try shorting near $50k

The Bulls’ Defense:

The outside reversal we pointed out has now played about and we have a short term change in the direction of price action

Price well above $40k resistance

The Bears’ Prosecution:

Major resistance at $50k

ETH Outlook

If you missed last week’s newsletter, I pointed out that ETH was looking setup for a potential move to $3k-$3.3k. Well, we are at $3,150 and showing the first signs of consolidation. I suggested last week that once we got here picking up a short could be a good idea. I haven’t shorted yet as I am thinking we get one more leg up to poke above $3.3k. From what I am seeing now $3.7k would be the level to try a short. Maybe, I am wrong and now is the best time to short. I am not thinking we get a big move down either way but something in the range of -5% to -10%.

Okay – going so far as shorting is not necessary, but if you took the trade we suggested last week from $2600 - $3.1k then consider taking some profits in the coming days/weeks.

Possible Course of Action

Scale out of position if long since $2600

Do nothing and wait for consolidation

Open a short near resistance ($3.3k-$3.7k)

The Bulls’ Defense:

EIP-1559 has burned $5,549,025,969 (1,792,300 ETH) so far. Supply constraints should continue to have a positive impact on price.

Short term bottom has formed, next major resistance $3.3k

The Bears’ Prosecution:

ETH price will stall out at $3.7k and multi-month weakness continues

Please don’t forget to like (heart button at bottom) and share this post!