Foot To Foot #5 Confessions of a Crypto Noob

A Foot Guns community members shares lessons for crypto noobies.

Be sure to follow us on Twitter.

My Crypto Journey

I work for a tech company, so tech itself is not at all foreign to me, but the world of Crypto, Blockchain, DeFi, dApp, NFT, etc. was (and arguably still is).

Several times in the last 5+ years I’ve considered doing some level of investing in Crypto fueled mainly by media hype and FOMO. But apathy to invest the research time and fear of the unknown always won out, and I just never got to it. Then on a whim, with no research and no plan, I just dove into the Crypto pool on 6th September 2021. To say I had no idea what I was doing is an understatement. I set up an account on a CEX, deposited some fiat, and did a shotgun allocation of those funds into some coins I’d heard of on the news or some other random source.

Over the next couple days, if a coin’s value went up I FOMO’ed more funds into it, and if it went down, I traded it to a coin going up at that moment in time… It’s not that I had completely zero idea about investment strategies, but in those first two or three days all sensible trading decisions went out the window. Then there were a few days of basically all the coins I’d randomly selected going down in value, and I finally took a breath and started to apply some more rational and reasoned thinking.

This article has no investment wisdom or quick wins. It is simply some lessons learnt from the dumb stuff I did, that, in retrospect, is obvious and “common sense”. Nonetheless, I’ve documented these lessons so other complete novices don’t need to make the same basic errors. If you’re a pro at this, I’m sure you have better things to do with your time than to read on.

The Basic Dos and Don’ts

Some of the basic lessons that should become common sense in crypto:

Only trade with money you are willing to lose.

Take profits. Unrealized Gains don’t pay bills.

Remember (at least in my jurisdiction), every trade is a taxable event.

Early on while you still have your training wheels on, take an even smaller portion of your allocated trading funds and experiment. Try bridging between networks, try getting into Liquidity Pools, Farms, Vaults, and Staking. Try swapping coins. If you screw up and lose some coins, rack it up as lessons learnt. Note: I’d just suggest don’t do your experiments on the ETH Mainnet where high gas fees will be limiting.

Early on in your learning curve do not get into any leveraged positions; that can come later.

Research and understand Impermanent Loss (see Understanding Impermanent Loss).

The first time bridging or transferring to a new wallet, try small amounts first to test if everything is working ok.

One of the first and most basic lessons I learned was you must add a token to Metamask for a token to be visible. I had bridged some ETH from the ETH Mainnet to the Avalanche network and thought I’d lost all the tokens not realizing I simply had to add the token to the Avalanche network in Metamask to see it (and I also learned about WETH in that same transaction). I’ve since been surprised in Discord and Reddit chats how often I’ve seen that mistake repeated by novices.

While I haven’t done this myself yet, take some time to get to at least an intermediate competency in Technical Analysis.

You can’t be in every project. Learn to walk away from some and ignore FOMO. Fair chance you were getting by just fine prior to being into Crypto. Chances are you’ll survive if you miss the next “big thing”.

Getting into projects

Before you Ape (buy something with no prior knowledge) into any project, take the time to DYOR (Do Your Own Research); understand the utility and use case of the project, and undertake Fundamental Analysis. To aid in that analysis, start with investigating on CoinGecko or CoinMarketCap. Also refer to CryptoRank. The examples below are on CoinGecko.

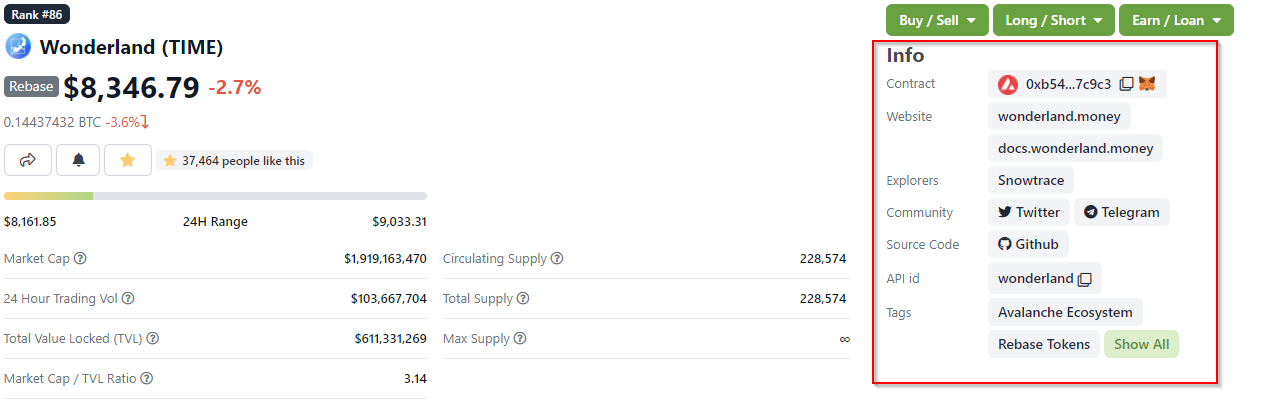

In the example below key information for a coin can be found in the highlighted section. Explore the coin’s website and whitepaper. If these don’t exist or are scarce, this is a red flag.

Find your project on Discord, Twitter, or Telegram and follow it. No social network or no community involvement and engagement is a red flag.

How much liquidity exists for the coin? Before investing large sums, try a small bag first and make sure you can exchange coins back out again. This can also test to see if it is a Honeypot.

Research the team behind the project. If they are anonymous or you find anything suspicious in their past, that’s also a red flag.

Don’t get rugged

A rug pull happens when developers siphon off the investors' money and abandon the project after a huge amount is allocated to the fake crypto or DeFi project.

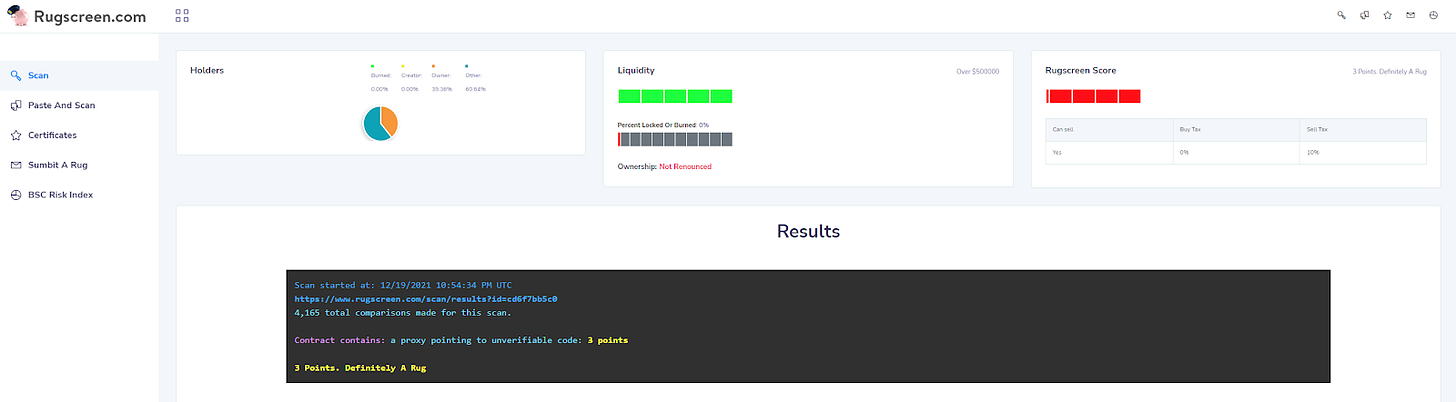

Two examples of tools for additional analysis are Is that Coin a Scam and Rug Screen. An example from Rug Screen is below:

You can investigate the risk of a potential Rug Pull by using a Blockchain Explorer to understand the distribution of the project’s token across wallets. If a small number or just one wallet holds most of the tokens this may also be a red flag and a Rug Pull may result.

Blockchain explorers for some different networks:

ETH Mainnet -Etherscan

Avalanche -Snowtrace

Binance Smart Chain -BscScan

Fantom -FTMScan

Polygon -Polygonscan

Harmony - Harmony Block Explorer

Moonriver -Moonriver

Arbitrum - Arbiscan

Terra Luna -Terra Finder

Solana -Solana Explorer

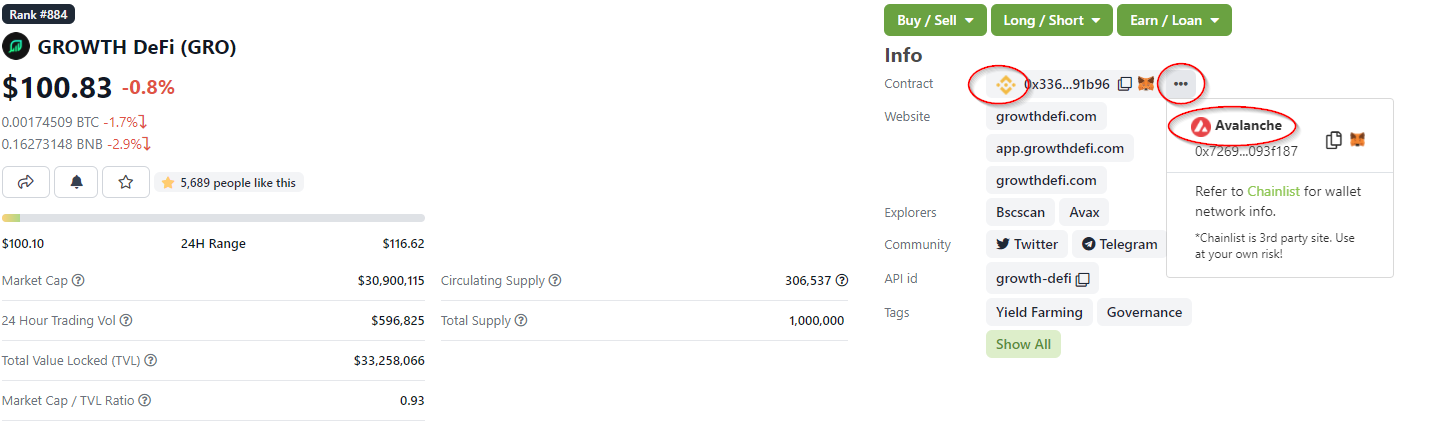

These Blockchain Explorers are also great for finding the contract address of a coin on a given network. Another handy way to find which networks a coin is supported on, and to get the coin’s contract address is to use CoinGecko. The example below shows that this coin is supported on Binance Smart Chain and Avalanche, along with the contract addresses for both networks:

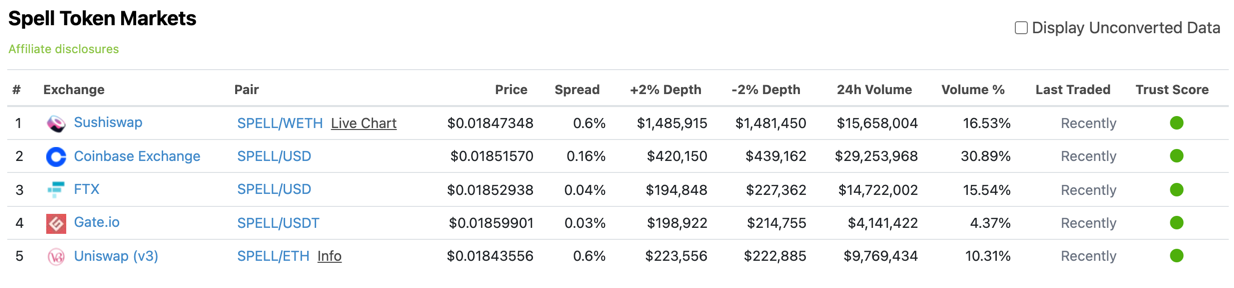

You can also use CoinGecko to find what exchanges a coin can be traded on.

Managing your DeFi portfolio

Some tools for visualizing your holdings:

Note, not all tokens are supported on all these tools, so you may need to use a combination of the above links to get a full picture.

Most Importantly

Subscribe to Foot Guns follow and participate in the conversations in the Foot Guns Discord.

Crypto moves fast and can be overwhelming so remember to take some time away from all this craziness.