The Foot Guns Crap Coin Index Is Here

The gang at Foot Guns have created an index that captures crappy crypto: FGCCI

07/29/2021 FGCCI - $18.93

Starting Next week, each Thursday we will post a free publication featuring a component of the FootGuns index. The index’ value will be published daily for our paid subscribers and weekly on Thursday to the free folk. We will also periodically publish it on our Twitter (@Foot_Guns) .

So we’ve made an index.

Why?

Because we want to capture what no other so called “crypto indexes” have attempted to—the level of irrational exuberance in the cryptosphere. While it may seem funny to develop such a crappy index, indexes that capture sentiment can be quite useful. What we don’t know yet, but we will soon find out, is whether a Foot Guns Crap Coin Index (FGCCI) will prove meaningful in terms of how to trade. An unusual move in the FGCCI may signal rotation of capital in the same way Dow Transports do.

Please let us know if there is a coin that has no use, or it is something that already exists in a perfectly good form, i.e., a “fork” that you think should be included—all you have to do is click reply to this email or leave us a comment.

So what’s a crap coin? We are trying to be slightly less offensive than the Bitcoin Maximalists who popularized the term Shit Coin. A shit coin is something that has no, little, or highly suspect use case. It’s existence either serves no purpose or it is a replica of something that exists and works properly. It’s inert. Does it mean its worthless? Probably, but as we have seen with Dogecoin, and a derivate Dogecoin, Shiba Inu, worthless things can go up in value.

For those holdouts who say its all worthless, we would say that the ability to create applications across say Ethereum has a use. Are people overvaluing that use? Maybe. But you can’t argue that it’s not useful to at least some one (in ETH case like a gazillion applications).

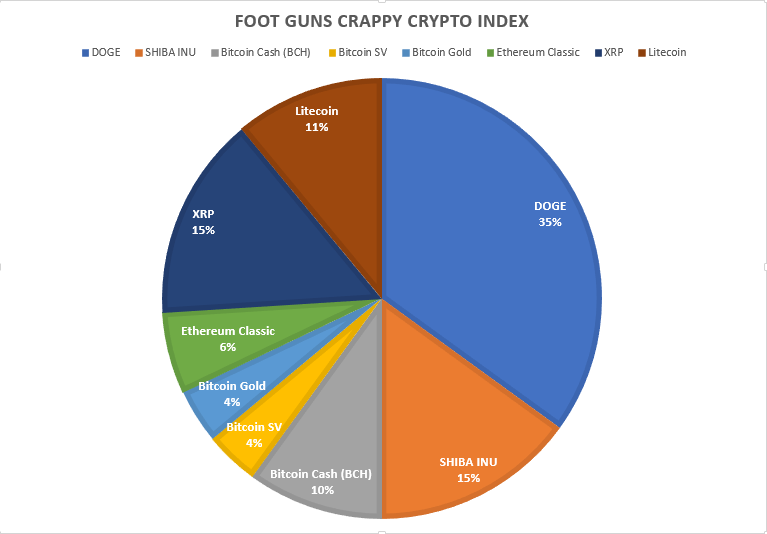

Breaking Down The Foot Guns Crap Coin Index (FGCCI):

Our next controversial move will be on the first rebalance when we will Binance Coin (BNB).

Here is a description of it from Coingecko

BNB: Binance Coin (BNB) is an exchange-based token created and issued by the cryptocurrency exchange Binance. Initially created on the Ethereum blockchain as an ERC-20 token in July 2017, BNB was migrated over to Binance Chain in February 2019 and became the native coin of the Binance Chain.

Binance Coin has seen massive growth in interest throughout the years. Several rounds of token burn events have appreciated BNB price and pushed it up as one of the top-10 cryptocurrencies by market capitalization. BNB can be traded in over 300 trading pairs across 120 exchanges tracked.

BNB merited inclusion in the index because it is an “exchange based token.” Although we are almost certain Binance does not pose a risk as an Exit Scam, it has irked regulators. Its CEO has repeatedly said it “does not need a physical headquarters.” But, if you were to need to find (sue) Binance, you are subjecting yourself to the laws of Malta. Maybe…Binance said it was located in the Caymans, but the Caymans said that was not true.

A legendary founder, an exchange that is better than Coinbase, but, ultimately its an exchange. How much would you pay for a hypothetical BAT’s exchange coin. Never heard of BAT’s? (No we aren’t talking about Basic Attention Token maybe we should add that next). CBOE paid $3.2bn for it in 2017. In 2016, Bats had become the second-largest U.S. equity exchange by market share and was the largest exchange-traded fund (ETF) exchange. Chances are if you have ever bought stock you have traded on BATS, you just didn’t know it. It did a hellova lot more volume than Binance does. And made more money. And the *actual exchange* sold for $3.2bn because it makes money—and it is useful.

But what about a BATs coin? What would you even do with that? Essentially if BATS had a token, you would use it to do…what…exactly?

Okay - well you can use BNB. Binance has created it’s own Ethereum clone called Binance Smart Chain. In order to use the applications built on top of Binance Smart Chain (BSC) you must get some BNB to pay for transaction fees. Similar to have you must have ETH to use applications on the Ethereum network. But why do we need Binance Smart Chain? Binance users were always able to withdraw their Ethereum and use the applications there. BSC now features clones of many Ethereum applications with the promise of cheaper, faster transactions. However, Ethereum2.0 will also give users cheaper transaction costs and layer 2 solutions like Polygon are seeing an explosion of user growth.

What’s important here is we are trying to capture sentiment. We noticed a correlation between Dogecoin’s explosive blow off and BNB’s ATH.

If you’re all bent out of shape about our inclusion of BNB we were only thinking of allocating a 3% of the weighted index. What do you think? Is this an outrage? Are you already upset by the coins we have listed? Send us a reply to this email or write a comment on the post telling us why your favorite token doesn’t deserve to be on this list.