Want more from Foot Guns? Subscribe to become a premium member and get more podcasts, more updates and access to our private channels in discord were we actively discuss trade ideas.

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, ETH, OIL, ES, and NQ as well as our favorite altcoins.

Crypto News

FTX walked away from a deal with Celsius after seeing its finances (The Block)

Lido community against limiting its Ethereum staking dominance (The Block)

Singapore authorities reprimand 3AC for providing false information (The Block)

Nansen to Track Solana NFT Data Amid Boom in Activity (CoinDesk)

JPM Says Crypto Market Deleveraging Cycle Won’t Be Lengthy (CoinDesk)

Basel Committee: Banks’ Bitcoin Holdings Should Be Capped (CoinDesk)

North Korean hackers suspected for $100M Harmony attack (CoinTelegraph)

OpenSea Warns of Phishing Attacks Due to Data Breach (Blockworks)

Grayscale Sues SEC Over Rejection of Proposed Spot Bitcoin ETF (Blockworks)

Indian Crypto Companies Are Relocating to Dubai, Singapore (Blockworks)

Napster To Launch Its Own Token On Algorand (Decrypt)

‘Gray Glacier’ Upgrade Goes Live on Ethereum Network (Decrypt)

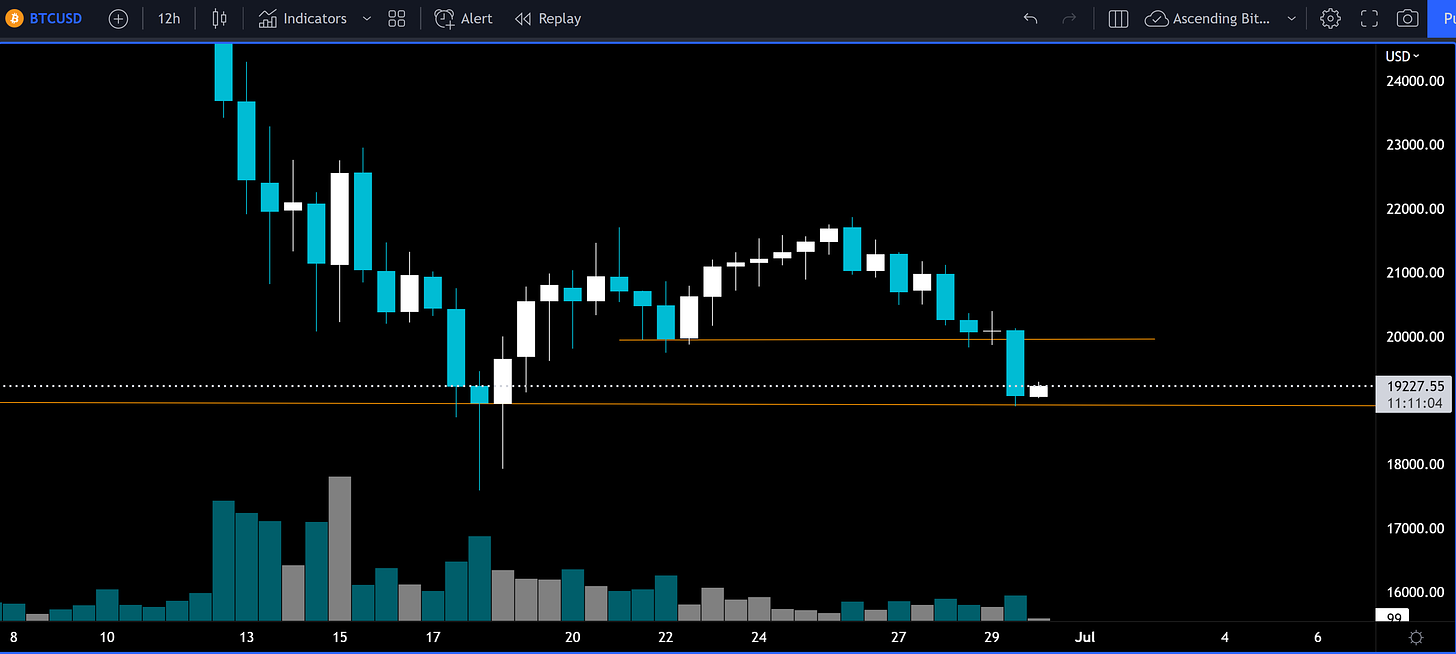

BTC Outlook

Here’s the line in the sand we mentioned in our Weekly Update Yesterday, and this morning BTC has help that as support so far. Notice also that very little volume came in during last night’s sell off. The next 12 hour candle will be important to watch. This will extend through today’s wall street trading hours and into the evening. If BTC stays above $19000 today we’d expect a retest of $20k and only when $20k is rejected as resistance would we expect $19000 to then begin to fail as support. It’s also entirely possible this current 12 hour candle never makes it above $19400 and sellers pour in. All of this isn’t exactly telling of where the price will be going next so stick to the Cheat Sheet bias and support and resistance levels. When things become uncertain the Cheat Sheet has been the best resource for understanding when trends will continue or turn arounds are likely.

Possible Course of Action

Scale into a long under $20k as a long term hold (3+ years)

Long under $20k for a short term retest of $20k

Do nothing and wait for a breakout

Short targets if BTC loses $20k ($19k, $15k, $9k)

The Bulls’ Defense:

Downtrend has lost momentum

The Bears’ Prosecution:

Global macro uncertainty

Highly correlated to ES and NQ which are selling off

ETH Outlook

Checking back in on the ETH/BTC ratio this morning you can see that there has been a lot of consolidation around the 0.055 level that we pointed out some time ago. This is an important level because it represents the breakout point from May 2021 when ETH began is run to $4000+. The consolidation is still young and patterns can morph, but it appears to be forming a rising wedge. This is a bearish formation, however, there is probably an opportunity here for a swing trade as ETH/BTC is likely to retest 0.055 and then possibly 0.06. So, with tight stop losses one could try and buy the bottom of this pattern and short the top. If this pattern does breakdown it’s important to watch this dashed line just under 0.05. A bounce off that level as support would mean the pattern has shifted and consolidation will continue near 0.055.

Possible Course of Action

Caution here as ETH is highly correlated with the tech stock sell off

Wait for BTC to rise above 50-day MA before long ETH

Swing trade this wedge with tight stop losses

The Bulls’ Defense:

EIP-1559 has burned $2,585,194,718 (2,501,446 ETH) so far. Supply constraints should continue to have a positive impact on price.

ETH 2.0 launch

Short term upswing inside of consolidation possible

The Bears’ Prosecution:

Global macro uncertainty

Nasdaq correlation and sell off

ETH/BTC pair continues to be weak

Want more from Foot Guns? Subscribe to become a premium member and get more podcasts, more updates and access to our private channels in discord were we actively discuss trade ideas.