Want more from Foot Guns? Subscribe to become a premium member and get more podcasts, more updates and access to our private channels in discord were we actively discuss trade ideas.

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, ETH, OIL, ES, and NQ as well as our favorite altcoins.

Crypto News

Reddit is releasing blockchain-based avatars (The Block)

Binance hires former PayPal exec as CFO, may IPO in 'coming years' (The Block)

Immutable X (ETH Layer 2) Will Allow Ether-to-Dollar Withdrawals (CoinDesk)

Solana Labs, Multicoin Accused of Violating Securities Law (CoinDesk)

Shiba Inu Plans to Launch Stablecoin, Reward Token, Card Game (CoinDesk)

Ethereum testnet Merge mostly successful (CoinTelegraph)

Singapore crypto exchange freezes withdrawals (CoinTelegraph)

MakerDAO Adopts Real-World Assets (Blockworks)

Genesis Reveals Exposure to Bankrupt Three Arrows Capital (Blockworks)

Majority of Ethereum 2.0 Stakers Underwater (Decrypt)

Argo Blockchain the Latest Crypto Mining Firm to Dump Bitcoin (Decrypt)

SBF's Alameda Research Owes Bankrupt Voyager $377M (Decrypt)

Elon Musk's Boring Company to accept Dogecoin in Vegas loop (Mashable)

BTC Outlook

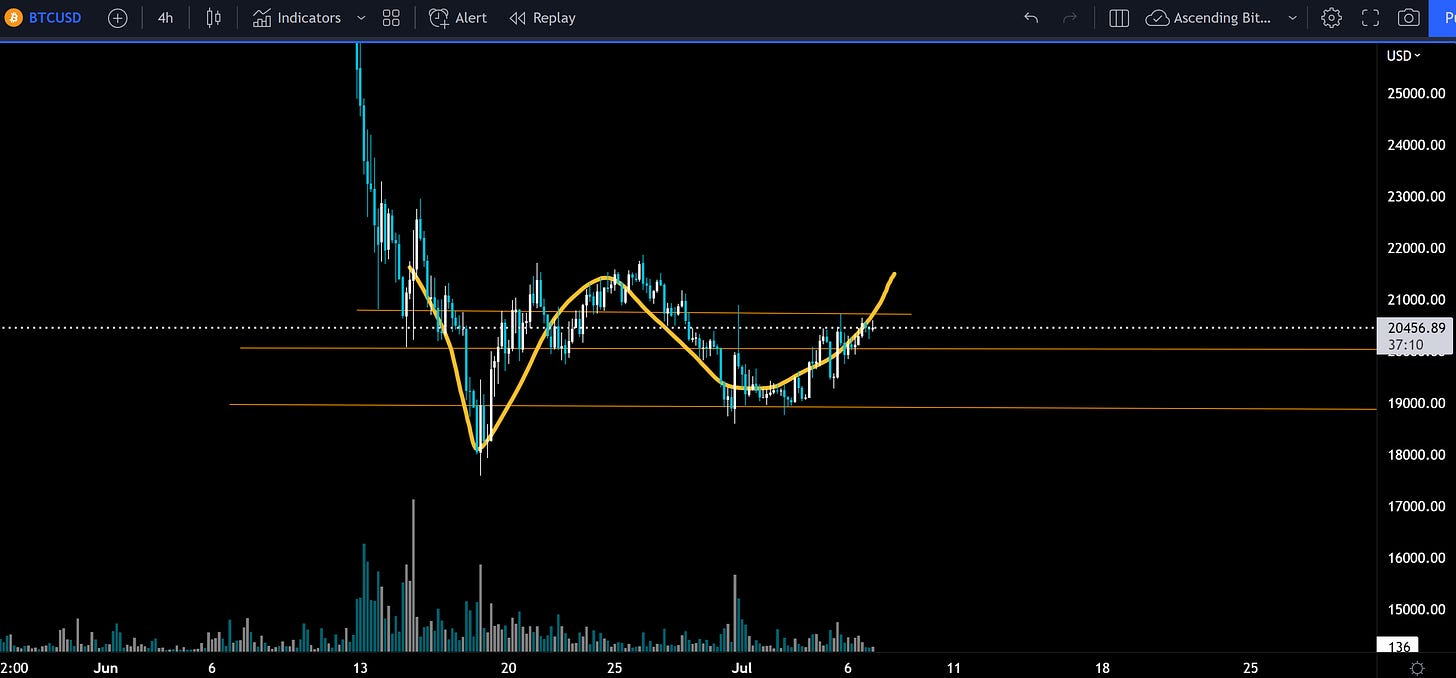

Bitcoin has officially put in a higher low rallying off the first of the month. However, there is still some proving to do if it is going to leave this range to the upside. Holding above $20,000 is a show of strength and if it can continue on and hold $22,000 as support than this will complete a power double bottom pattern called, Adam and Eve. This is when a sharp V is followed by a rounded bottom. This is one of the most power W bottoms that can result in a parabolic rise to the upside. Don’t jump the gun here though.

If $21,000 acts as resistance then this pattern will never full form and more downside can persist. Specifically, if Bitcoin falls back below $20,000 and stays there for multiple days then the pattern morphs into a bearish pennant with a downside target below $17k. As always you can try to trade the range between $20k and $21k but don’t expect the price to rally or fall until these key levels are broken ($20k or $22k).

Possible Course of Action

Long if $21-22k holds as support

Trade the range (long $20k, short $21k)

Short targets if BTC loses $20k ($19k, $15k, $9k)

The Bulls’ Defense:

Downtrend has lost momentum

Potential Adam and Eve forming

The Bears’ Prosecution:

Global macro uncertainty

Highly correlated to ES and NQ which are selling off

Potential Bear Pennant forming

ETH Outlook

Similar to BTC/USD , the ETH/BTC pair appears to be in an uncertain moment where more downside would confirm a bear flag (ascending wedge) and more upside and holding 0.057 as support would be confirmation of a double bottom. I personally shorted this yesterday and today and so far it’s been going against me. To be more prudent you could wait until a daily candle closes confirming 0.057 as resistance or support. If 0.057 acts as support I’ll be closing my short and otherwise stay in the trade for a retest of the bottom of this wedge. Surprisingly, ETH had one of the strongest rallies post-FOMC so pay close attention here. Whichever direction is chosen is likely to sustain for the remainder of July.

Possible Course of Action

Long ETH if 0.057 acts as support

Short ETH if 0.057 acts as resistance

Wait for BTC to rise above 50-day MA before long ETH

Swing trade this wedge with tight stop losses

The Bulls’ Defense:

EIP-1559 has burned $2,974,902,983 (2,517,946 ETH) so far. Supply constraints should continue to have a positive impact on price.

ETH 2.0 launch

Short term upswing inside of consolidation possible

post-FOMC rally

The Bears’ Prosecution:

Global macro uncertainty

Nasdaq correlation and sell off

ETH/BTC pair continues to be weak

Want more from Foot Guns? Subscribe to become a premium member and get more podcasts, more updates and access to our private channels in discord were we actively discuss trade ideas.