Cheat Sheet -

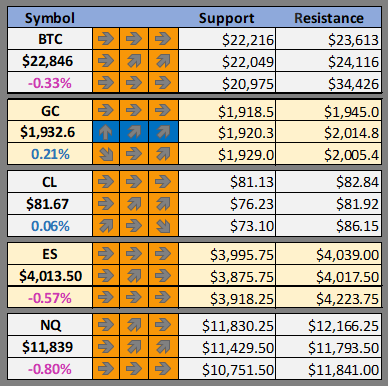

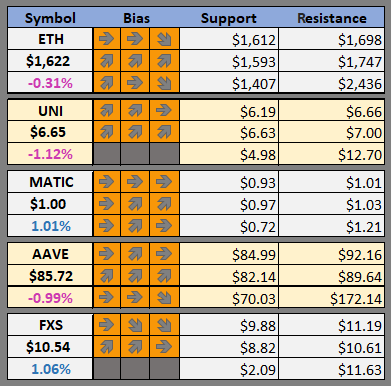

Support and resistance levels and our daily, weekly and monthly bias on BTC, GC, CL, ES, and NQ as well as our favorite altcoins

Are you new to Foot Guns? Learn how to read the cheat sheet here.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

FBI confirms Lazarus Group and APT38 were responsible for $100 million bridge hack (The Block)

French National Assembly to vote on mandatory crypto firm licensing (The Block)

Binance Mistakenly Mixed Crypto Exchange's Client Funds With B-Token Collateral (CoinDesk)

Binance Processed Nearly $346M of Bitcoin Trades for Crypto Exchange Bitzlato (CoinDesk)

Uniswap holders propose ditching Ethereum for BNB Chain to deploy v3 protocol (CoinTelegraph)

Aave’s Hotly Debated V3 ETH Pool Up for On-chain Vote (Blockworks)

Sushi To Roll Unclaimed Governance Tokens Into DAO Treasury (Blockworks)

EU Lawmakers Pave Way for Stricter Crypto Rules for Banks (Decrypt)

OpenSea Sales Rise in Consecutive Months for First Time in a Year (Decrypt)

MSTR Outlook - To The Moon!

We are taking a break from Bitcoin watching this morning to have a look at MSTR. If you’ve been with us for a while you’ve seen our “From The Desk Of A Trader” series where it was pointed out over a year ago the risk Michael Saylor was taking with his company by first moving MicroStrategies cash holdings into Bitcoin and then using leverage by selling debt in his own company to investors with the explicit intention of buying more Bitcoin.

One of our readers asked me this morning “Why Is MicroStrategy mooning?”. So, I thought I’d take a stab at it.

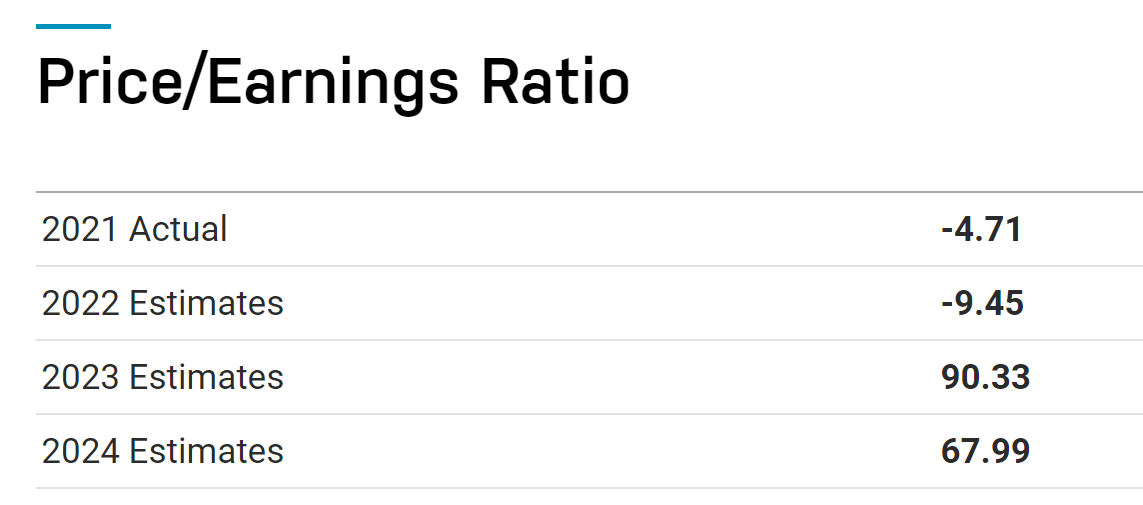

Investing in stocks is about discounting future cash flows. This means the basic first step is to identify the ratio of the stock price to the earnings to know if you are getting a good price for the stock. Here’s the top results on google:

I’m sure a bloomberg terminal would come in handy here for trying to find the real data, but from the above we can now conclude that an average retail investor googling the PE of MicroStrategy will see that it is somewhere between, “Not Applicable” and 3249.75, negative or just 0.

Nasdaq claims MSTR had a negative P/E in 2021 and 2022, which must mean the earnings were negative because the stock price never traded below 0 as far as I can tell. They also estimate that after two years of negative PE the stock will have a 90 PE in 2023!

Well these numbers seem bogus, so I dug deeper and found this on tradingview:

Yes, in August last year MSTR had a Surprise earnings per share upset of -36,057%. Well the biggest thing you should take away from this is whatever analyst is estimating MSTR EPS is bad at their job. According to google in Q2 last year they missed EPS by -9999%.

So, why is the stock mooning in 2023? I think we all know the answer. Simply because Bitcoin is going up. I personally don’t see why any retail investor would touch this stock if they want crypto exposure.

Here’s MSTR normalized by the Bitcoin price:

If you bought this at the end of 2021 when Bitcoin started its rally from $18k to $69k you’d be down versus just buying Bitcoin.

MicroStrategy reports earnings on February 2nd. The two EPS estimates I can find are 0.98 and 0.02. Considering MSTR hasn’t had an earnings beat since Jan 2020, the stock could rally on an earnings beat, but how can it possibly beat earnings after the awful year 2022 was for crypto?

Want more from Foot Guns? Join our Discord where we have live conversations about the market.